The UK Financial Reporting Council (FRC) has concluded that there is “some scope for improvement in a number of aspects” of the work carried out by auditors on defined benefit (DB) pension scheme liabilities.

The audit regulator probed the accounts of 125 DB scheme sponsors under International Accounting Standard 19, Employee Benefits (IAS 19), over the past year.

Just eight of the audits in the sample were deemed to have no areas requiring improvement. In just under half of cases, “at least one aspect of the audit work performed over pensions” required limited improvements.

FRC executive director Melanie Hind said: “The valuation of pension obligations is complex, requiring significant judgements and assumptions that carry the risk of material misstatement and/or manipulation.

“Auditors need to understand the work of actuaries inputting to their work and pay attention to assets as well as liabilities.”

Hind added that the FRC hoped its decision to highlight both good practice and areas for improvement would raise standards.

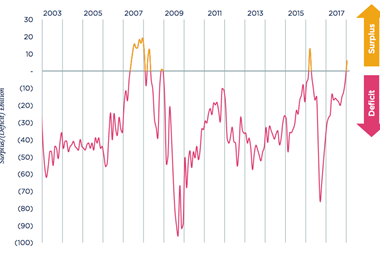

Matt Davis, a partner at consultancy firm Hymans Robertson, said the report’s findings could lead to a narrowing of discount rates and a corresponding rise in reported pension deficits.

He said: “Auditors may be more cautious in the discount rates they are comfortable with and may be more likely to push back and challenge companies.”

Davis urged sponsors to engage with pensions accounting, because an increased willingness on the part of auditors to challenge their assumptions risked derailing the year-end process.

In total, the FRC’s report singled out nine areas of concern. Among them was the risk posed by changes in key assumptions such as mortality.

The report also said some auditors had failed to document evidence to support conclusions made by experts such as actuaries. In addition to overseeing the work of the audit profession, the FRC also supervises actuaries under a separate disciplinary scheme.

In one case, the FRC said there was “insufficient evidence” on the audit file about the discount rate, salary increase assumptions, mortality rates and cash commutation figures relied upon in the accounts.

The FRC also called on auditors to do a better job of assessing DB plan assets in areas such as asset ownership and valuation.

‘Missed opportunity’

However, one pensions lawyer told IPE the FRC’s findings and report were a “missed opportunity”, as IAS 19 undervalued risk.

Anne-Marie Winton, a partner at ARC Pensions Law, said: “I see this as a missed opportunity by the FRC – they are starting from the wrong place.

“The IAS 19 valuation will invariably be significantly lower than the funding valuation that is agreed with the trustees, for example.”

Winton added that the core problem was not one of professional incompetence, despite some of the immediate media responses to the report.

“The problem is that we are not comparing like with like,” she said. “In my view, the figures in the financial statements fail to highlight the level of risk to investors.

“The reason is that the accounting is done on a best estimate basis, whereas the funding is on a prudent basis.”

The FRC first revealed its plans to monitor the quality of DB accounting and disclosures in December 2016.

Alongside this action, the FRC’s corporate reporting review team released a thematic review of pensions disclosures in November 2017.

The FRC justified its decision to focus on DB accounting on the grounds that, although net DB obligations on company balance sheets were not always significant, the underlying asset and liability account balances could be.

This article was updated on 31 July to clarify the focus of the FRC’s report in the first paragraph.

No comments yet