The pensions debate in Europe has been given a boost by the substantial might of the European Round Table of Industrialists (ERT), whose members have a combined turnover of e950bn and employ over 4m people.

The ERT turned to the state of Europe’s fragmented pensions industry last year and subsequently issued a report, European Pensions, An Appeal for Reform, in which it outlined the pressing need for Europe to take a serious look at pensions and retirement provision in line with its changing demographics.

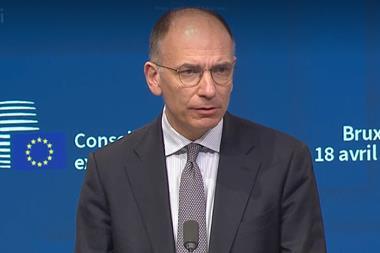

The report was prepared by the ERT Welfare Society Working Gorup which is chaired by Carlo De Benedetti, the chairman of Italian company CIR, and the president of the Fondazione Rodolfo Debenedetti (FRD), the Milan-based applied and policy-oriented research foundation that assisted the ERT in its study by offering research support.

“We hope this report will make European governments feel the urgency of the reforms required to prevent the collapse of the current pension schemes,” says De Benedetti. He points out that reforms take time to implement and that too much time has been lost. “It is now time to act. The report calls for immediate policy action and provides a set of recommendations that can be implemented by national governments and which identify ways to co-ordinate reform efforts at European level.”

De Benedetti says there are four main reasons why Europeans should act multilaterally. “Europeans should think now about the Europe-wide implications of the breakdown of the current pension arrangements. European countries are facing similar adverse demographic scenarios, which will invariably require a similar set of solutions. The ERT is an organisation comprising industrialists of an integrated Europe and is aware of the fact that delays in reforming pensions in one country can be a burden on others. An integrated Europe needs free movement of workers and capital, and neither can be fully realised without flexible pension arrangements.”

This last point forms one of the main recommendations the report makes to the EU and calls for the cross-border transfer of pensions entitlement to facilitate employees’ freedom of movement, stressing that such transfers could be helped by the creation of co-ordinated tax policies designed to eliminate the double taxation of benefits.

The gradual reduction of vesting periods (the period governing eligibility for benefit), which at present vary greatly among member countries, would help remove regulatory obstacles to pensions mobility, though the ERT feels tax relief for plan sponsors should accompany any such reductions.

A flexible approach to investments should be adopted, covering not only asset classes, but geographic location and the ERT feels that employees’ best interests would be protected if private funds respected the prudent man principle, whereby returns are maximised for a given level of risk.

At national level the ERT identifies a different set of priorities.

Spending on public pensions needs to be prioritised so that a basic standard of living for the elderly can be ensured, something the ERT believes private sector pensions cannot do.

A proper balance between public and private pension provision should then be established, while the retirement age ought to be harmonised among member states, with older workers being encouraged to remain in the workforce beyond retirement age if they wish to.

The report also recommends that governments should not add to pensions costs by automatically linking benefits to nominal wages or promoting early retirement and that the private pensions markets should be opened up with emphasis on stimulating competition, whilst individuals should be encouraged to start saving towards their retirement.

Tax incentives for employee contributions to company-sponsored schemes should be provided and fiscal barriers to private pension investments should come down.

Tito Boeri, director of the FRD, confirms that the report received a lot of attention but that there is some way to go before real progress is seen. “Many embassy delegations and government ministers asked to see the report, but there is still a lot of work to do.”

To help move things along, Boeri says tthat the FRD is preparing another report collating the results of a Europe wide survey to gauge ordinary citizens’ opinions on pension reform, but given the diversity of schemes and culture in Europe, this is not an easy job.

Boeri believes that the European Commission’s task is two fold. “What the Commission needs to do is work on the portability of pension schemes and to inform. It is a huge task.”

The portability question applies mainly to the private pensions system, since cross border transfer of public plans is already possible, but the directive proposed by the EU was delayed yet again at the last summit of leaders in Stockholm. “More recently we have seen statements saying it is time to conclude on this issue, and this is certainly the most important issue facing the Commission at this time,” says Boeri.

Informing people of the long-term sustainability of pension schemes is equally daunting. “Quite a lot of work has been undertaken in this area as well, but getting together accurate projections means working from a long term perspective, at least looking as far ahead as 2050. And you have to respect the differing nature of research and information available in different countries.”

However, the Commission’s influence is limited since it is not an universally elected body. “It’s difficult for the Commission to do much, since pension reforms are sensitive issues and involve country-specific problems and institutions. Since it is not politically accountable, the Commission is unable to intervene in issues of this nature,” Boeri comments. This is where national governments come more into play, but early indications of ongoing FRD research into pensions reform at national level reveal that little has been achieved. “At national level, unfortunately, we have not seen much progress.”

No comments yet