A new era for occupational pensions appears to be dawning in Spain. Of most interest to corporate sponsors are the latest developments in the incidence, type and level of private pension coverage among progressive employers.

As in most other places, government has had a big hand in creating the need, the means and the incentives for private pension supplementation. Designed in the 1960s, the social security programme aimed to provide generous pension benefits (up to 100% of final covered earnings for full career employees). Given the high level of employer contribution rates (30% of covered earnings), the government´s main response - unpalatable as it may be politically - has been and will be the gradual curtailment of benefits.

Another driving factor is the constitutionally enshrined right of all individuals to retain their jobs for as long as they wish to work. Employers in Spain are not allowed to dismiss employees on account of old age (except upon agreements with unions under sectoral negotiations).

The third driver of the latest trends in plan design is the newest piece of pension legislation, which requires the external funding of any pension promises undertaken by an employer with its employees.

Law 30/95, enacted in November 1995, established only two vehicles for funding pension obligations - a qualified pension plan (a vehicle created by legislation 10 years ago) and a group insurance contract.

The new law introduces extremely stern actuarial valuation and funding requirements, with the aim of ensuring the financial soundness of the pension arrangements. Perhaps the weight of these requirements has removed the last bit of oxygen left from the 1987 legislation for DB programmes, at least for those that would have been funded under qualified plans. In any event, worldwide practices, certain financial attractions and employee preference for DC designs are certainly making their presence felt.

Finally, global pressures for ever-increasing cost-containment, more employee mobility, and a definite awareness of the need to save for retirement, along with a call from government for more individual responsibility for one´s own welfare, are tremendous forces behind a move toward employee cost-sharing, more realistic benefit targets and full and immediate vesting of accumulating benefits.

In support of the above, the results of a recent survey we conducted among 68 companies confirm that there is a clear movement to DC approaches.

In analysing any surveys one should not be confused by raw percentages. In fact, in looking at the initial statistics in the survey, it would appear that Spain is still a DB pension plan country. According to the survey, most defined benefit plans were implemented prior to 1990. Since 1990, four out of every five new plans have a DC format. The DB plans are mostly one-off arrangements with the very top executive.

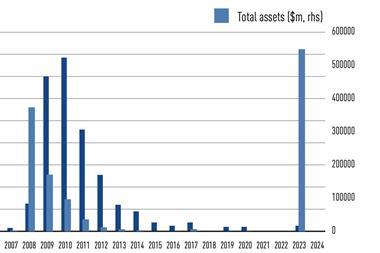

As main conclusions, we see sufficient evidence to predict an unprecedented growth in the number of new private pension plans (we believe that most of them are under a DC format), the amounts of accumulating assets from a meagre 3% of GDP to 20% over the next 10 years and continuing interest on the part of employees in their financial future after retirement.

No comments yet