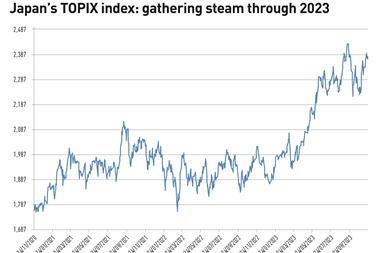

Pension funds are becoming tangled in a maze amid an inability to determine proper forex hedging strategies. Many funds use forex hedging in short-term forward-exchange agreements in which they sell foreign currencies and buy yen. As the US Fed seeks an exit from its quantitative easing policy, there is growing concern over an eventual widening in the spread between foreign and domestic short-term interest rates, that is, a rise in hedging costs, which could hurt investment returns in FY2014 and beyond. At the same time, pension funds that have not hedged for forex risk have been rewarded by the boost in returns from the large correction in the overvalued yen (rise in foreign currency values) since last November. Pension funds are putting themselves increasingly at the mercy of the unpredictable forex markets. Should a fund take or avoid forex risk? Should forex be seen as a source of returns or simply as an exchange rate? Many pension funds have distinctly different views of and thus different ways of dealing with forex. The hedging services offered by management firms can differ greatly depending on a fund’s goals and reasoning.

Fujikura’s pension fund has a relatively high 24% weighting of foreign bonds, all of which are hedged. It plans to continue its hedging for now, but leaves open the possibility of a reduction in this weighting if the hedging costs should rise and threaten its bond returns. At Tokyo Gas, which uses a contract system, over half its portfolio consists of foreign-currency assets. The entire amount is hedged, but the company is uncertain whether this system will remain viable in the future given the risk of an upturn in hedging costs. The key worry at both of these companies is the problem of hedging costs.

Takahiro Mitani, President of Japan’s colossal Government Pension Investment Fund (GPIF), says the fund will, as always, refrain from forex risk hedging. “If we were to engage in forex hedging (buying yen, selling foreign currencies), the impact on the markets would be huge, encouraging a rise in the yen. We would be cutting our own throats.” That is, the fund will continue to accept forex risk. At the same time, there are indications the fund might have refrained from rebalance-related selloffs as well in its foreign-currency asset portfolios, which have ballooned amid the yen’s decline since last autumn. A similar phenomenon was suggested in the October-December (3Q FY3/14) quarterly results at some employee pension funds (EPF), released on 1 March. At that time, GPIF’s basic portfolio plan called for a 17% allocation for foreign-currency assets, but the actual weighting at the end of December was 22.72%. Some market participants felt it strange that GPIF had not attempted to rebalance by shedding such assets. EPF are highly sensitive to changes in the GPIF portfolio, since the volatility of their “daiko” portions (funds managed on behalf of the government) are linked to overall EPF returns, which are similar to GPIF returns. The Okayama Prefecture Metal & Machinery Pension Fund voted at a board meeting in April to expand its forex exposure sharply from ¥6.5bn ($66m) to ¥9bn. It had previously managed its daiko funds in line with GPIF’s allocation plans, but has now switched to a method reflecting actual market weightings (at time of results announcement). Funds normally work out short-term forward-exchange agreements with banks every three months, putting together hedging positions consisting of buying yen and selling foreign currency. In this process, they receive yen interest rates from the banks while paying foreign currency interest rates. The latter is usually greater in the case of yen hedging and is thus the hedging cost.

However, the three-month Libor as of 1 July was 0.16% for the yen, 0.27% for the US dollar, and 0.15% for the euro. The dollar/yen hedging cost is 0.27 – 0.16 = 0.11% or nearly zero. By comparison, the euro/yen cost is in negative territory at -0.01%. With the euro payout rate lower than yen receiving rate, investors enjoy a “hedge premium” that imposes no cost. The spread has been negative since mid-August last year.

As such, hedging costs at present are around zero. Japan was the first to undertake a zero interest rate policy, and the US and Europe have followed since the Lehman shock, leading to a contraction in the spread. This has created a strikingly cheap hedging environment for domestic pension funds. However, costs have also been known to reach high levels in the past. For instance, dollar/yen hedging costs hovered between 4-5% from late September 2005 through December 2007, and the euro/yen cost exceeded 4% at one point after the Lehman shock. The simple average (daily) over the past ten years for both the dollar/yen and euro/yen was around 1.8%.

During that time, pension funds lowered their risk levels, aiming at returns of 2-3%. The ratio of foreign-currency assets varied significantly, but an average cost of 1.8% is hardly insignificant for funds hoping for returns at the 23% level.

In 2004, the yen skidded from ¥100/dollar to ¥120/dollar. Dollar-buying made sense from an asset approach as evident in carry trades, involving investment in high-earning dollars on funds procured in low-cost yen. A dollar/yen hedging position essentially amounted to accepting high hedging costs and abandoning the benefits of a weak yen. At the same time, the stock markets remained relatively robust until the financial crisis. Despite dissatisfaction over forex hedging since 2004, pension funds were able to ignore this thanks to solid returns from equity investment and continued to hedge in an orderly manner.

However, as stagflation gave way to higher interest rates and a slump in both stock and bond prices, pension funds could no longer afford to cast away the weak yen merits. Few pension funds envision stagflation as a main scenario at this stage, but remain mindful of the possibility.

No comments yet