Icelandic pension fund Frjálsi is now increasing its allocation to foreign alternative investments in its investment policy, in the latest phase of its drive to boost its allocation to foreign assets.

In the Reykjavik-based fund’s newly-published investment policy for 2020, the fund said it plans to continue the ongoing development of the last few years, and increase the diversification of its foreign portfolio further.

“In addition to investments in foreign equities and bonds, alternative foreign investments are now on the list,” Hjörleifur Waagfjörð, head of Arion Bank´s institutional asset management, told IPE.

He said that for Frjálsi, alternative asset classes now being considered include real estate, private equity, private credit, infrastructure and commodities, which would together make up a new asset category for the fund.

These investments would be made via funds rather than directly, he said, and Frjálsi plans to pick the external managers to provide this exposure.

The fund envisages achieving an allocation of 3-4% to this asset category in three years’ time, he said, as the category would take some time to build up.

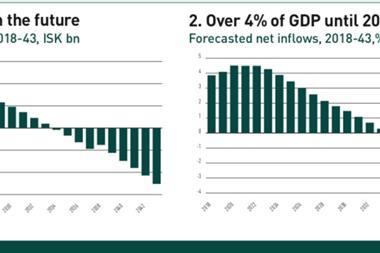

Frjálsi has been growing fast due to solid inflow and sound returns in the last few years, and currently has total assets of around ISK285bn (€2bn), he said.

Iceland’s economic collapse of 2007/8 put a stop to the process of geographical asset diversification that the country’s pension funds had been engaged in, because capital controls were abruptly imposed and restricted foreign investment other than reinvestments.

But with the gradual relaxation of these limits in the last few years, the funds are now making up for lost time, working to raise their allocations to foreign assets.

However, up to now, including alternatives has been difficult for funds with similar structures to Frjálsi, Waagfjörð explained.

In 2009, legal changes opened up the possibility for pension scheme members to get early redemptions to their individual defined contribution pensions (IDC), which in turn meant Frjálsi had to have a high level of liquidity in its investment portfolios.

“Also, at that point in time the fund members were understandably quite risk averse, and many moved their IDC from a more risky path, where the nature of assets tend to be less liquid, to a more risk-averse path,” he said.

With capital controls now lifted, and the possibility of an early redemption gone, the situation is more stable and the fund has seen it as appropriate to diversify further and build up an exposure to foreign alternatives, he said.

Looking ahead, the ratio of fixed income, other than government bonds, will continue to increase within Frjálsi’s portfolios, as has been the trend of recent years.

Under current market conditions, the pension fund said treasury bonds would not necessarily yield enough to meet future disbursements of collective defined contribution pensions.

“As in previous years, the weight of domestic bonds other than government bonds has, therefore, increased in the fund’s investment policy for 2020,” said Waagfjörð.

Meanwhile, Iceland’s Financial Supervisory Authority (FSA) reported earlier in December that the country’s pension savings grew to just over ISK5trn (€36bn) at the end of the third quarter.

The data on total assets of the country’s pension insurance and private pension savings published by the regulator showed that pension funds’ foreign assets stood at around ISK1.43trn on 30 September, up 4.3% or ISK59bn from the end of the second quarter.

These foreign assets accounted for 33% of total assets, the FSA said, stating in its report that this proportion had never been greater.

No comments yet