Reports

In-depth report on investing for our pension fund and asset management readers from our award-winning journalists.

Latest reports

Emerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?

Manager selection: Solving the pension liquidity puzzle

Advisers and fiduciary managers are working as hard as ever to meet the liquidity needs of pension funds

Netherlands Country Report 2024: The pension transition dilemma

Dutch pension funds must tread a fine line between protecting funding levels and ensuring sufficient returns as they move to defined contribution

Private lending shows signs of recovery

Private credit is showing signs of recovery, but investors are focusing on defensive sectors

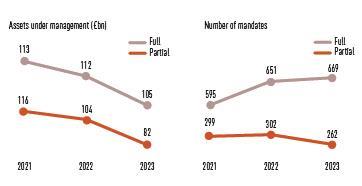

IPE Top 500 Asset Managers 2023: Asset management at a pivotal point

Data highlights from IPE Top 500 Asset Managers 2023: 2022 global asset management AUM is €102.6trn | 5.5% reduction on the 2022 total of €108.6trn | Global institutional AUM: €35.1trn | European institutional assets: €11.5trn

Top 1000 Pension Funds 2023: Europe’s pensions absorb a €646bn loss

Last year saw a net reduction in the asset stock of European pension investment retirement pools of 6.77% over the previous year, according to IPE’s annual study of the leading 1,000 pension funds across the continent, marking a sea change for pensions.