- Will Germany's extraordinary spending plan bring benefits for investors?

Top stories

Asset owners hold course as Middle East conflict raises market volatility

Middle East tensions drive market swings, but pension funds focus on resilience, risk management, and strategy

UK pensions regulator urges small DC schemes to offer drawdown or merge

Small DC schemes risk consolidation as TPR urges them to offer in‑scheme drawdown for members

German pension consulting market consolidates amid reform and competition

The shift away from guarantees in private pension products is also expected to open the market to new competitors

PensionsEurope slams plan to retain SFDR rules for occupational funds

The trade body described the potential revisions as ‘a structural misfit for IORPs’

Proxy-advisor support for shareholder proposals has plummeted, finds research

Support for sustainability-related shareholder resolutions by ISS fell from 39% in 2024 to 7% in 2025, while Glass Lewis saw a drop from 26% in 2024 to 21% in H1 2025

Home country bias – an asset owner’s take on a persistent debate

Capital doesn’t respond to slogans – it responds to incentives

Soil carbon has emerged as a legitimate asset class

The announcement in January that Microsoft has made a commitment to purchase 2.85m soil carbon removal credits from Indigo Carbon PBC over a period of 12 years suggests that something fundamental has changed in the soil carbon credits market.

The UK’s ‘deep tech’ sector: a paradox for policymakers and institutional investors

Deep tech now represents 31% of all UK venture funding – a threefold increase from a decade ago

Thoughtful engagement with AI is no longer an option for asset managers and pension funds

The arrival of AI into the investment process has the potential to vastly amplify existing research-related information disparity

People moves: Schroders names head of UK institutional

Rachel Harris will reinforce Schroders’ commitment to the UK market and focus on continued growth

Velliv Foreningen CEO lauds Danish pension system, ponders next step

Over his 40-year career in pensions so far, Lars Wallberg has seen profound changes in Denmark’s pension system

People moves: Railpen names chief risk officer

The UK £34bn railways pension fund has also appointed a chief people officer

Asset owners hold course as Middle East conflict raises market volatility

Middle East tensions drive market swings, but pension funds focus on resilience, risk management, and strategy

Home country bias – an asset owner’s take on a persistent debate

Capital doesn’t respond to slogans – it responds to incentives

IPE UK Briefing: Reform UK reveals plan to end DB fund for local government workers

Plus: TPR’s code of practice for collective defined contribution (CDC) pension funds; PPF’s levy

Buyout increasingly perceived as less attractive for large defined benefit schemes

Strong funding and control drive large UK DB pension fund to rethink buyout as the default endgame, says Brightwell

When net zero targets fail, fix the system, not the frameworks

Frédéric Ducoulombier, programme director at EDHEC Climate Institute, argues that value-chain complexity and Scope 3 uncertainty have become convenient alibis

AkademikerPension adds extra layer of risk

Known as the ‘Jesus of Gentofte’ for its ESG stance, the Danish fund is revitalising its approach to investing. CIO Anders Schelde explains the rationale behind it to Rachel Fixsen

Velliv Foreningen CEO lauds Danish pension system, ponders next step

Over his 40-year career in pensions so far, Lars Wallberg has seen profound changes in Denmark’s pension system

‘Pension funds are economically interesting creatures with deep social relevance’

The outgoing CEO of Finnish pension fund lobby group TELA speaks to Rachel Fixsen about intellectual challenges, taking difficult advocacy positions and her future plans

Insourcing versus outsourcing: a deceptively simple question

Leading executives at the UK’s NEST Invest, France’s ERAFP and Germany’s Bosch Pensionsfonds spoke to Joseph Mariathasan about operational and asset allocation challenges

CaixaBank’s Blanch: time to move from rhetoric to action

As chair of Pensions Caixa 30, Yolanda Blanch is committed to forging ahead with what she describes as “systematic leadership”

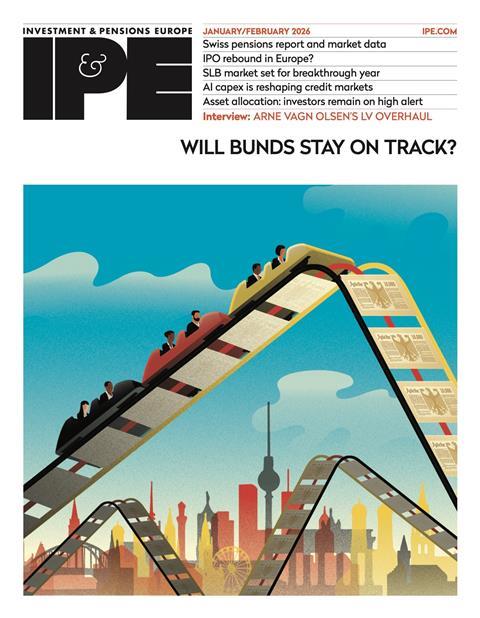

IPE Magazine January/February 2026

Read the latest issue of IPE Magazine

Browse the digital edition and find highlights from this month's issue below

Digital edition of IPE magazine

January/February Highlights

European equities: IPO market set for rebound amid policy uncertainty

A renaissance in European stockmarket flotations needs to be backed by more supportive policies

Sustainable capitalism should ditch Milton Friedman’s flawed approach

Nobel Prize-winning economist Milton Friedman’s influence on corporate behaviour and investment philosophy continues to resonate decades after his famous 1970 New York Times article declaring that the sole social responsibility of business is to increase profits.

Fiduciary assets plateau as UK market matures

UK pension schemes are de-risking through insurance in growing numbers, while many are choosing run-on strategies – and fiduciary managers must adapt

Insourcing versus outsourcing: a deceptively simple question

Leading executives at the UK’s NEST Invest, France’s ERAFP and Germany’s Bosch Pensionsfonds spoke to Joseph Mariathasan about operational and asset allocation challenges

CaixaBank’s Blanch: time to move from rhetoric to action

As chair of Pensions Caixa 30, Yolanda Blanch is committed to forging ahead with what she describes as “systematic leadership”

Fixed income, rates, currencies: Joint US-Israel war on Iran sends oil price to 12-month high

Global markets had seemed relatively benign despite signs of impending instability – but the military strikes on Iran have upended any optimism

Chart watch: Policy uncertainty, EM spreads, US jobs, German manufacturing

Despite global policy uncertainty, EM spreads have remained tight, and German manufacturers ended 2025 on a high

- Previous

- Next

- Previous

- Next