Top stories

Relief for pension funds as retaliatory tax code dropped from US budget bill

Section 899 pulled after G7 countries agreed to exempt US companies from parts of global minimum tax rate deal

Fondo Espero appoints Schroders, Amundi for ‘Crescita’ sub-fund

The €1.5bn Italian pension fund for school employees has also selected Eurizon Capital for a tail risk hedge mandate

BVV restructures management as it targets new industries for DC plans

German pension fund appoints CIO and chair of three pension vehicles

KLP divests US, German firms for supplying IDF in Gaza

Denmark’s AkademikerPension relaxes responsible investment policy on defence

Jesal Mistry to leave Legal & General Investment Management

Mistry has helped L&G navigate the Mansion House agenda driven by the UK government

LGPS fund commits £25m to nature-based infrastructure fund

West Yorkshire Pension Fund backs firm that aims to raise £10bn for nature-based infrastructure over the next decade.

Collaboration between UK government and investment industry is crucial to support growth

‘Our ambition is for the UK to become the world’s most innovative full-service financial centre—and we’re already making progress’, says investment minister

Pension funds become embroiled in Italy’s banking M&A battles

Cassa Forense, Enasarco, Enpam and Inarcassa face questions over their stakes in Monte dei Paschi di Siena, Mediobanca, and Banco Popolare Milano (BPM)

Staples pension fund concludes buyout with Aegon

The Dutch company pension scheme, with €660m in assets under management, has been closed since 2015

NBIM calls for investor-driven clarity in sustainability disclosure reforms

In a response to the ISSB’s Exposure Draft on amendments to IFRS S2, NBIM cautioned against changes that could undermine coherence or comparability

FCA probes risk trade-offs in push for UK growth

FCA’s Kate Collyer stresses the importance of understanding the potential trade-offs when introducing more risk

Jesal Mistry to leave Legal & General Investment Management

Mistry has helped L&G navigate the Mansion House agenda driven by the UK government

People moves: UK’s NEST confirms Ian Cornelius as CEO

Plus: LGPS Central appoints Nigel Peaple as director of policy; EFAMA elects new president, vice president

People moves: HSBC Global Asset Management names CEO

In addition to his CEO role, Dan Rudd has also been appointed head of UK wholesale for HSBC GAM

Viewpoint: Is a government like a business?

Peter Kraneveld argues that governments need to learn and accept the differences between government and private business

Viewpoint: Five trends to watch in the European pension risk transfer market

Rohit Mathur of Prudential Financial says UK de-risking trends are being seen globally, driving demand for PRT and longevity hedging solutions

Proposed tax on retirement savings threatens Australian Super system

Australia’s new government wants to tax unrealised gains on superannuation savings

Pension funds become embroiled in Italy’s banking M&A battles

Cassa Forense, Enasarco, Enpam and Inarcassa face questions over their stakes in Monte dei Paschi di Siena, Mediobanca, and Banco Popolare Milano (BPM)

IPE Netherlands Briefing: PME picks Candriam to run concentrated portfolio

Plus: Social affairs minister Eddy van Hijum proposes 12-month extension for pension funds to implement new interest rate hedging and investment policies

German experts warn active pension alone will not solve labour shortages

Germany’s proposed ‘Aktivrente’, or active pension, is a step towards encouraging older workers to remain in employment

How the asset management industry seeks to reinvent itself

The latest survey by Citi Investor Services and CREATE-Research highlights the new sources of organic growth and new client groups available to the asset management industry

New PensionsEurope president wants to simplify membership structure

Jacques van Dijken, the new president of PensionsEurope, wants to rid the organisation of its two-tier membership structure, giving every country equal influence

Faith Ward MBE on net-zero narratives, transition finance and safe spaces for mistakes

Faith Ward, the highly respected chief responsible investment officer at Brunel Pension Partnership, speaks to IPE just days before being recognised in the King’s Birthday Honours

Systematica Investments CEO Leda Braga on the hedge fund's strategy

‘Ten years ago, we were the nerds, the geeks, and nobody was interested’

PenSam CIO Claus Jørgensen on the fund's focus on low-risk, high-quality pensions

Claus Jørgensen, CIO at PenSam, talks to Carlo Svaluto Moreolo about the Danish pension fund’s efforts to maximise pension payouts

IPE Magazine May/June 2025

Read the latest issue of IPE Magazine

Browse the digital edition and find highlights from this month's issue below

Digital edition of IPE magazine

May/June Highlights

Get dirt rich to save the earth: Soil as an asset class

Nature can provide almost 40% of greenhouse gas reductions needed by 2030, according to research published in 2017 by the Nature Conservancy.

The scarce commodity of active management skill

Active management skill remains elusive but it can be identified by means of effective analytics, with common attributes such as trading skill and concentrated portfolios

European pension funds review global weightings in face of US turmoil

As global markets react to the threat of US tariffs, many European pension funds are looking to rebalance their portfolios and reset their investment policies

Italy’s Enasarco in talks to offer asset management services to third parties

The €9.3bn first-pillar pension fund for sales representatives seeks to expand the role of its own asset management company, Miria Asset Management

UK court cases spell trouble for passive shareholders

In the Allianz vs Barclays case, passive investors have been denied damages related to investments in companies releasing misleading information

The scarce commodity of active management skill

Active management skill remains elusive but it can be identified by means of effective analytics, with common attributes such as trading skill and concentrated portfolios

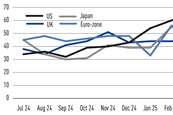

IPE Quest Expectations Indicator - June 2025

At last, we have some clarity about the nature of ‘Trump risk’ – it is about uncertainty and growth. Markets are signalling that the US president’s on-again-off-again policies are a threat to growth and stoking inflation even if his threats are not implemented.

- Previous

- Next

- Previous

- Next