All IPE articles in December 2024 (Magazine) – Page 2

-

Asset Class Reports

Asset Class ReportsInvestors eye return to European small cap equities

Largely dependent on domestic investors, interest has been growing in the opportunities offered by Europe’s smaller companies

-

Country Report

Country ReportDanish pension funds split over venture capital opportunities

PensionDanmark is backing early-stage venture capital investments but its peers are shying away from VC

-

Opinion Pieces

Opinion PiecesThe private credit market needs careful monitoring

European institutional investors seem to be in a bind. Equities performed well this year, but market concentration remains at record levels and many investors expect a correction. Returns from bonds have been mostly positive, but that could change if inflation flares up again. The real estate market may be starting to recover, but it is early days, and the recovery may not be linear.

-

Special Report

Special ReportSecurities litigation: the view from our institutional clients

Over the last year we have continued to see a steady stream of new group investor actions brought across Europe, arising from serious alleged governance failures.

-

Opinion Pieces

Opinion PiecesFuture of ESG investing in doubt following decisive Trump victory

In the past two years, an anti-ESG backlash has grown strong roots on the American right.

-

Interviews

InterviewsHow pension funds manage derivatives and liquidity needs

The use of derivatives, for hedging and other purposes, is common among pension funds, but it can be a drain on liquidity. We asked three pension funds how they ensure adequate levels of liquidity when interest rates are volatile

-

Special Report

Special ReportUK group litigation funding: Devil in the detail

Third-party litigation funding (TPLF) has become a key ‘must-have’ for opt-in group litigation in Europe, but in July 2023 the UK Supreme Court made a ruling that potentially threw a spanner in the works for such funding used in UK lawsuits.

-

Special Report

Special ReportPassive investors: price/market reliance and the due diligence question

Towards the end of October 2024, the High Court in London struck out claims for £335m (€402m) being sought from Barclays for misdemeanours dating back over ten years.

-

Analysis

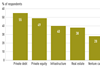

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Asset Class Reports

Asset Class ReportsEquities: US equity markets expected to gain from Trump’s victory

As the political dust settles following Donald Trump’s victory in the US presidential elections, global equity funds are eagerly eyeing the incoming administration and the opportunities it may offer

-

Country Report

Country ReportInterview: Tina Rönnholm, Erik Fransson, Fondtorgsnämnden (FTN)

FTN urges fund management companies to dedicate time and resources to its RFPs

-

Interviews

InterviewsLeapFrog eyes global impact investment opportunities

Impact investing was once a niche concept. “We were seen as the weird people in the corner of the room,” recalls Andy Kuper, the South African founder and CEO of LeapFrog Investments

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

Special Report

Special ReportInvestor litigation outside the US on the rise

Class-action lawsuits have been a staple of the litigation landscape in the US for decades, but this trend is now spreading, with investor litigation on the rise across the UK and Europe

-

Interviews

InterviewsAP7 boosts internal management as it reaches quarter-century milestone

Sweden’s DC buffer fund is boosting internal capacity and embarking on a hiring spree as it seeks to adapt to a harsh new investment environment

- Previous Page

- Page1

- Page2

- Next Page