The EU pension fund supervisor has launched a consultation on the methodological framework for stress-testing Institutions for Occupational Retirement Provision (IORPs).

It is understood to be EIOPA’s first such discussion paper on stress-testing methodology for IORPs – as opposed to insurers – and includes a chapter on the introduction of stress-testing of environmental risks within an IORP stress-test framework.

EIOPA said the framework in its paper set out theoretical and practical rules, guidance and possible approaches to support future IORP stress test exercises.

“This conceptual approach is expected to make IORP stress test exercises more efficient, in particular for the IORPs to carry out the stress test and the national competent authorities and EIOPA to validate and analyse the results,” it added.

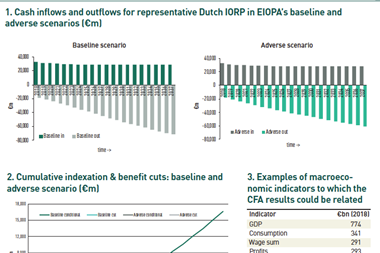

The paper introduced a “toolbox approach,” EIOPA said, consisting of analytical tools and approaches that could appropriately capture the characteristics of both defined benefit and defined contribution pension funds.

The deployment of the different tools could be tailored to the specific objective of the stress test, it added.

Pekka Eskola, chief economist at PensionsEurope, said the industry association welcomed that EIOPA “is willing and interested in improving its stress testing methodology for IORPs”.

“We also thank EIOPA for having taken many of our concerns and suggestions into account,” he told IPE in a statement. “We are ready and happy to provide our expertise to EIOPA to further improve its stress testing methodology for IORPs – regarding the discussion paper particularly on ESG stress testing but on many other issues as well, including cash flow analysis, horizontal approach, and liquidity.”

EIOPA has initiated and coordinated three EU-wide IORP stress tests, which are implemented by participating pension funds themselves.

The last IORP stress test was in 2019. Specialists in the Dutch pension fund industry saw this one as including several improvements on the exercises of 2015 and 2017, such as in the form of a new cash flow analysis approach, but still made recommendations for further changes.

EIOPA’s methodological paper is split into eight chapters, covering the objective(s) for the stress test, tool selection, scenario design and risk factor selection, application to climate risks, application of shocks, data collection, and disclosure and communication.

The consultation is open until 22 September. EIOPA said all comments would be duly considered and where necessary, the paper would be modified accordingly.