All IPE articles in March 2022 (Magazine) – Page 2

-

Opinion Pieces

Opinion PiecesEditor's letter: Could CDC provide a solution to the pension income problem?

This month sees the close of a consultation in the UK on a new code of practice for authorisation and supervision of collective defined contribution (CDC) pensions schemes. Trustees will be able to apply to set one up from August this year.

-

Interviews

InterviewsHow we run our money: Church Commissioners for England

Church Commissioners for England CIO, Tom Joy, tells Susanna Rust about the fund’s pursuit of genuine diversification and responsible investment.

-

Country Report

Country ReportQ&A: Regulator takes stock on climate risk reporting

IPE asks DNB climate policy specialist Sven van den Beld for a progress report on how pension schemes are monitoring carbon-related risks

-

Special Report

Special ReportCSDR’s settlement penalties kick in

New regulations attempt to clarify and standardise securities settlement procedures

-

Features

FeaturesStrategically speaking – WTW: Democratising private markets

WTW’s ill-fated merger with Aon, announced at the outset of the pandemic in early March 2020, would have shaken up the corporate insurance brokerage market. It would also have created an outsourced CIO (OCIO) giant to compete with Mercer in terms of delegated assets under management (AUM).

-

-

Features

FeaturesPerspective – Liability-driven investing: DIY LDI

A multi-decade trend of falling interest rates, the increased complexity of financial markets and the growing burden of regulation have conspired to turn pension provision into an extremely sophisticated activity. This is especially true for defined benefit pension funds, which may be facing a gradual decline in number, but remain a key source of retirement income.

-

Opinion Pieces

Opinion PiecesViewpoint: Greenwashing needs to be pinned down

On 10 March 2022, the EU’s Sustainable Finance Disclosure Regulation (SFDR) turns one. In terms of how it was drafted and how it has been implemented, it hasn’t exactly covered itself in glory, although it was high time regulators got involved to try to bring some order into ESG-land.

-

Country Report

Country ReportDutch pension funds tackle inflation

With a nominal liabilities framework under the current FTK rules and a new system around the corner, Dutch schemes are not rushing to inflation-proof their portfolios

-

Interviews

InterviewsOn the record: Emerging markets

Despite the current volatility and geopolitical tensions, European pension funds continue to actively seek returns from emerging market investments.

-

Special Report

Special ReportMiFID II: A threat to European sustainability?

MiFID II is unintentionally jeopardising the long-term objectives of ESG investors

-

Opinion Pieces

News Notes: Private investing ‘levels up’ playing field

The UK’s recent government white paper – ‘Levelling up the United Kingdom’ – forcefully pushes for private investing. In it, Prime Minister Boris Johnson claims he is determined to “break that link between geography and destiny, so that it makes good business sense for the private sector to invest in areas that have for too long felt left behind”.

-

-

Asset Class Reports

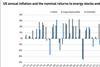

Asset Class ReportsPortfolio Strategy – Inflation: A new regime

CIOs and asset allocators discuss the effect of inflation on portfolios

-

Special Report

Special ReportPensions regulation in The Netherlands

Developments in the pensions landscape in The Netherlands

-

Special Report

Special ReportPensions regulation in Switzerland

Developments in the pensions landscape in Switzerland

-

Special Report

Special ReportPensions regulation in the UK

Developments in the pensions landscape in the United Kingdom

-

-

Special Report

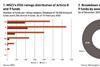

Special ReportRegulation: SFDR put to the test

One year in and the verdict on the EU’s Sustainable Finance Disclosure Regulation (SFDR) is mixed

-

Special Report

Special ReportSpecial Report - Regulation

Europe’s flagship SFDR regime for ESG was never intended to become a fund-labelling framework. So as Susanna Rust also writes in this issue, it is a relief that the EU is now consulting on minimum requirements for Article 8 funds. In this Special Report, we look in some depth at how asset managers have embraced SFDR, taking in the broad reclassification exercise that has taken place to relabel existing funds, and the short-term risks of greenwashing. In the longer term, the hope is for much more standardisation and there are signs that this is already happening.

- Previous Page

- Page1

- Page2

- Next Page