United States – Page 2

-

Opinion Pieces

Opinion PiecesUS budget bill battle fazes Australian super funds

With around A$750bn (€420bn) allocated to the US, Australian super funds are bracing themselves for the impact from a raft of policies being rolled out by the Trump administration.

-

Opinion Pieces

Opinion PiecesEurope must forge its own trade relations policy with China – without relying on the US

Iran has recently been in the headlines, but while its relations with the US have ramifications across the Middle East, the more profound longer-term issue may be America’s relationship with China, as Washington beats the drum of a new cold war with Beijing.

-

Features

FeaturesFixed income, rates, currencies: Questions over US economic policy dominate global concerns

As ever, the US dominates the global economic landscape. While there is still considerable uncertainty around possible tariffs emanating from the US – despite deals struck by the UK, China and Vietnam – the levels are still expected to be markedly lower than those trumpeted on 2 April.

-

Asset Class Reports

Asset Class ReportsUS versus Europe: will private credit investors shift focus?

As market volatility persists, private credit investors are starting to rethink their allocations to the US in favour of Europe

-

Analysis

AnalysisThe state of shareholder rights in US and the EU

While US regulators and state legislatures chip away at shareholder rights, the EU takes a more measured – if sluggish – approach to reform, Sophie Robinson-Tillett reports in the second of a four-part series on stewardship and shareholder rights

-

Analysis

AnalysisFixed income, rates, currencies: Questions over US economic policy dominate global investor concerns

The likelihood of a full-scale global trade war has decreased, and the outlook for the global economy has improved as a result, but new tariff announcements by the US administration could cause this scenario to change once more

-

News

NewsRelief for pension funds as retaliatory tax code dropped from US budget bill

Section 899 pulled after G7 countries agreed to exempt US companies from parts of global minimum tax rate deal

-

News

NewsPensionsEurope raises ‘serious concerns’ over One Big Beautiful Bill

US senate is expected to vote on the reform legislation on Monday

-

News

NewsAP7 loses patience with Tesla’s labour conduct, divesting €1.2bn

Swedish pensions giant set to make more climate exclusions as a result of upcoming policy change

-

News

NewsDanish pension fund CIO takes floor at Alphabet AGM over targeted ads impact

Google-parent AGM votes down call from AkademikerPension, United Church of Canada Pension Plan and others for independent human rights assessment of AI-driven advertising effects

-

News

Nordic pension funds hold off on dialling down strategic US exposure

Danish pension funds favoured European equities in Q1, central bank data shows

-

Features

FeaturesIPE Quest Expectations Indicator - May 2025: US markets lose their wings

Markets have been gyrating wildly with Trump’s on-again-off-again trade wars, but resistance is building

-

Features

FeaturesIPE Quest Expectations Indicator - June 2025

At last, we have some clarity about the nature of ‘Trump risk’ – it is about uncertainty and growth. Markets are signalling that the US president’s on-again-off-again policies are a threat to growth and stoking inflation even if his threats are not implemented.

-

Special Report

Special ReportBlended finance could help achieve sustainable development goals despite Trump

New approaches will be needed to encourage asset managers and institutional investors to participate in blended finance

-

Features

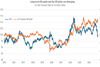

FeaturesChart watch: Uncertainty ripples across markets

The trade war unleashed by Trump’s tariffs and the knock-on effects for business confidence and commodities demand are reflected in our latest chart overview

-

Opinion Pieces

Opinion PiecesBeyond the ESG backlash – what next for European asset owners?

The US asset management landscape is rapidly transforming, with a re-evaluation of investment priorities shaped by political pressure and regulatory change. For European asset owners this brings both uncertainty and a rare opportunity to achieve strategic clarity, provided they are willing to look beyond the short-term chaos.

-

Opinion Pieces

Opinion PiecesAustralian super funds split on US exposure post Trump tariffs

Just weeks after Australian super funds visited the United States to pitch investments worth hundreds of billions of dollars, US president Donald Trump delivered a body blow with his ‘Liberation Day’ tariff plan.

-

Special Report

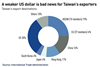

Special ReportIndia could benefit from global trade disruption

As other nations reel from the ongoing trade tariff uncertainty, Delhi appears relatively insulated from the direct impact of US levies compared with its more export-reliant Asian peers

-

Features

Fixed income, rates, currencies: Fickle US policy shakes global investor confidence

The hugely unpredictable policy announcements from those in charge of the world’s largest developed economy are market events more usually associated with goings-on in a newer EM economy

-

Analysis

AnalysisEuropean pension funds review global weightings in face of US turmoil

As global markets react to the threat of US tariffs, many European pension funds are looking to rebalance their portfolios and reset their investment policies