-

The world is nervously watching for any updates on US tariffs as the 90-day pause comes to an end

-

The macro environment for US credit is currently quite positive

-

As several bond markets have been influenced by international events, the currency markets have also seen large gyrations this year

-

Global FDI increased to a record $41trn in 2023, with the US extending its lead as the top destination for inward FDI, reaching a total of $5.4trn by year end 2023

As ever, the US dominates the global economic landscape. While there is still considerable uncertainty around possible tariffs emanating from the US – despite deals struck recently by the UK, China and Vietnam – the overall level of the eventual levies is still expected to be markedly lower than those announced on April 2.

Hence, upgraded forecasts for US economic growth mean downgraded chances of recession, though an economic slowdown is still the consensus with lower inflation expectations.

The possibility of a ‘lesser’ trade war actually improves the outlook for European economic growth, as it reduces the threat of a potential influx of cheap Chinese/Asian goods that have been diverted away from the US.

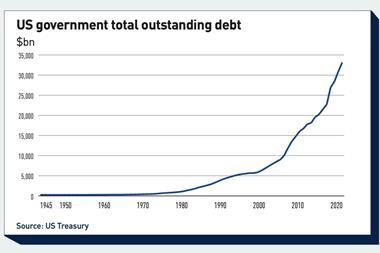

Though increased revenues from the higher than (currently) expected effective US tariff rate of 14% (compared with less than 3% at the start of the year) should be good for the US bottom line. But while estimates suggest it could theoretically lower the deficit by more than $2trn (€1.7trn) over the next decade, ongoing US fiscal deliberations still raise market anxieties.

US president Donald Trump’s tax-and-spending bill is set to increase the US national debt by an estimated $3.4trn in the near term, as tax cuts will precede spending cuts. Moody’s published projections for a federal budget deficit of 9% of GDP in 2035 are significantly higher than the consensus of 7-7.5%, but most economists agree that the figure is growing – which is rattling investors.

The European Central Bank and the Bank of England remain in easing/not restrictive mode. Business and consumer confidence across both regions are soft, reflecting global uncertainties as well as electorates disgruntled with domestic politics. In addition, concerns remain over tensions in the Middle East and the Ukraine/Russia war.

While the ceasefire between Iran-Israel seems to be holding, the degree of uncertainty remains very high, particularly with respect to Iran’s next moves. Prospects for Iranian oil supply and a potential disruption to the vital Strait of Hormuz, which sees almost 20% of the world’s oil pass through it daily, remain unclear. However, some of the more critical tail risks have dissipated following the US tactical strikes on Iranian nuclear facilities.

Bonds: benign environment despite deteriorating fiscal outlook

During the euro zone debt crisis, yields on certain top-rated Spanish and Italian corporates were trading at lower yields than their respective government bonds. Although Moody’s has downgraded the US government’s credit score from Aaa to Aa1, the situation for US bonds may be rather different.

The macro environment for US credit is currently quite positive. Nominal yields are high, the Fed has been lowering interest rates and economic growth, though slowing, is still positive. Crucially, America’s corporate balance sheets are generally in decent shape, and arguably significantly healthier than those of the US government.

However, the 2011-12 euro zone debt crisis raised the possibility of the bloc collapsing, with the attendant threat of the forced changing of currency denominations of the sovereign bonds of Italian, Spanish and other peripheral countries.

As well as some tax advantages to earning coupon income from US Treasuries as opposed to USD corporate bond income, the depth and the liquidity of the US Treasury market completely dwarfs those of its corporate bond market, an attribute valued highly by investors.

Bond yields in Japan have been moving higher across the curve since 2022, when the Bank of Japan began normalising policy and ending Yield Curve Control in 2023. While long rates globally have been rising fast in 2025 steepening yield curves, Japan’s super-long (30+ years) rate rises have recently been outstripping them all, reaching levels not seen since the start of issuance in 1999.

Fiscal deterioration in Japan is already concerning, from increased defence spending or the mooted lowering of consumption taxes. A couple of poorly received 20-year Japanese government bond (JGB) auctions in May brought into focus the precarious demand/supply balance in super-long JGBs, as Japanese life insurers, previously big buyers, stayed out having reached their regulatory solvency ratios. In response to rising yields, the finance ministry is now rumoured to be trimming its issuance at the long end.

Currencies: investors grapple with volatility and weakening US dollar

As several bond markets have moved more than others with international incidents often blending with domestic events and/or policies, the currency markets have also seen large gyrations this year. The Taiwanese dollar, usually a low-volatility currency, had its largest one-day move since the 1980s.

For a small island nation such as Taiwan, with few natural resources but an open economy where international trade is of paramount importance, heightened US tariffs or increased trade tensions are highly concerning.

Taiwan was one of the first countries in East Asia to attempt to broker a trade deal with the US, prompting rumours in the local press that some sort of currency agreement to weaken the exchange rate between their respective currencies would be part of the negotiations, despite assurances from the central bank that this would not be the case.

Nervous Taiwanese exporters, holders of huge amounts of US dollars, then rushed to get ahead of any potential moves of their policymakers thereby strengthening the domestic currency – and selling down USD markedly.

There may be other such idiosyncratic currency incidents, prompted by the sweeping changes in US policy that trigger big fear responses but are not necessarily based on underlying macro fundamentals, yet can still overwhelm market positioning, particularly in minor foreign exchange markets.

For investors, anchoring their views in well-researched macro-fundamental analysis is particularly hard given the background of tariff uncertainty and unsettled US policymaking.

Consensus forecasts now argue that unwinding the longstanding overvaluation of the US currency may become the dominant driver of major currency trends. Extensive US policy changes have fundamentally altered consensus views on the direction of the dollar this year, particularly as the drivers of US exceptionalism have been questioned. They now fear that this new era may bring with it more occasions when US stocks, bonds and the dollar all fall at the same time – typically a sign of capital fleeing a country.

US leads foreign direct investment to record high, while Europe sees decline

According to the IMF’s latest Coordinated Direct Investment Survey*, global foreign direct investment (FDI) increased to a record $41trn in 2023, with the US extending its lead as the top destination for inward FDI, reaching a total of $5.4trn by year-end 2023.

Europe has fared less well in attracting flows. Indeed, its overall FDI declined in both 2023 and 2024 – and remains below the record high set in 2017. The reasons for this downturn range from economic growth to sustained high energy prices and an unsteady geopolitical environment.

AT Kearney, a US global management consultancy firm, publishes an annual survey of top executives of the world’s largest companies to track the impact of political, economic and regulatory changes on FDI intentions and preferences. For 2024, the US remained the top-ranked investor destination.

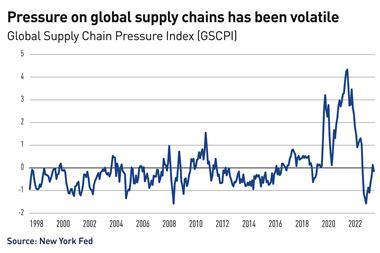

This year’s report was carried out in January this year before the new Trump administration had arrived at the White House. There were some notable survey responses, with a significant rise in the number citing an increase in rising commodity prices, perhaps driven by fears of rising global conflict and the possibility of supply chain disruptions.

In the fast-changing and somewhat unpredictable US policy environment, another survey is to be carried out later this summer to gauge any rapid changes in CEO attitudes to investment plans and/or destinations.

*https://www.imf.org/en/Blogs/Articles/2025/02/20/foreign-direct-investment-increased-to-a-record-41-trillion