Caroline Hay

Contact info

- Email:

- liam.kennedy@ipe.com

Analysis

AnalysisMacro focus: debasement and fiscal dominance

The price of gold and other precious metals will continue to soar next year, as investors shift focus away from currencies

Analysis

AnalysisFixed income, rates, currencies: bond markets ready to absorb record issuance

Sentiment remains upbeat, despite weakness in the US job market and uncertainty about Venezuela

Analysis

AnalysisFixed income, rates, currencies: markets shrug off the uncertain macro picture

The rising unemployment rate suggests all is not well in the US economy, but the rest of the world – namely China – is getting on with it

Analysis

AnalysisChart watch: cooling US job market, China’s record trade surplus, Venezuela’s oil reserves

US jobs data points to a slowdown, and the outlook for euro-area growth is dull

Analysis

AnalysisFixed income, rates, currencies: Global economies slow despite increasing tariffs clarity

The global fixed income outlook remains mixed, with strong economic headwinds despite fading fears of the AI bubble bursting

Analysis

AnalysisChart watch: Trade policy uncertainty, US job growth, European inflation

Trade policy uncertainty remains elevated, and the US is showing signs of a slowdown. In Europe, inflation numbers are reassuring

Analysis

AnalysisMilei’s Argentina finally shows signs of stuttering economic life

The president’s decisive victory in Argentina’s mid-terms indicates a mandate from the electorate for him to continue with his macroeconomic reforms

Analysis

AnalysisTrusting the numbers: Scepticism about macroeconomic data on the rise

Political interference in national statistics is not a new phenomenon, but the recent episodes in the UK and the US reveal a growing scepticism about macroeconomic data

- Analysis

Fixed income, rates, currencies: US heads for soft-landing

The US economy is on course to avoid a recession, thanks to the Fed’s clever tactics, but the effects of tariffs have yet to feed through

Analysis

AnalysisChart watch: Buffet Indicator, inflation expectations, gloomy German corporates

Manufacturing is expanding in the US, bond market volatility is lower, but sentiment is deteriorating in Germany, the UK and China

Analysis

AnalysisFixed income, rates, currencies: markets in wait-and-see mode as US job markets stall

Investors are desperate for clarity on how tariffs will affect exporters and importers to the US

Analysis

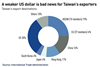

AnalysisChart watch: US dollar down 10% YTD, China faces deflation, Europe and EM rejoice

As domestic macro imbalances reach record highs, the economies of the US, China and euro-zone diverge

Analysis

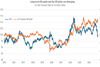

AnalysisFixed income, rates, currencies: uncertainty sends US stocks out of sync with bonds and currencies

Tariff-led recession fears have eased, supporting risk assets, but bond and currency markets are in ‘wait-and-see’ mode

Analysis

AnalysisChart watch: positive US GDP forecasts overshadowed by tariff unpredictability

Economists expect a benign macroeconomic environment, but all is predicated on the fickleness of US policy

Features

FeaturesFixed income, rates, currencies: Questions over US economic policy dominate global concerns

As ever, the US dominates the global economic landscape. While there is still considerable uncertainty around possible tariffs emanating from the US – despite deals struck by the UK, China and Vietnam – the levels are still expected to be markedly lower than those trumpeted on 2 April.

Features

FeaturesChart watch: Uncertainty following tariff announcements persists

Though much of the damage caused by the so-called 2 April ‘Liberation Day’ announcement of US tariffs has been repaired, uncertainties generally remain high.

Analysis

AnalysisFixed income, rates, currencies: Questions over US economic policy dominate global investor concerns

The likelihood of a full-scale global trade war has decreased, and the outlook for the global economy has improved as a result, but new tariff announcements by the US administration could cause this scenario to change once more

- Features

Fixed income, rates, currencies: Fickle US policy shakes global investor confidence

The hugely unpredictable policy announcements from those in charge of the world’s largest developed economy are market events more usually associated with goings-on in a newer EM economy

Features

FeaturesChart watch: Uncertainty ripples across markets

The trade war unleashed by Trump’s tariffs and the knock-on effects for business confidence and commodities demand are reflected in our latest chart overview

Features

FeaturesFixed income, rates, currencies: Trump’s tariff announcements weigh on sentiment

As tariff announcements garner huge amounts of media attention, financial market reactions have been muted. Participants are trying to beat off tariff fatigue and assess the best path through all the smoke and mirrors.