IPE’s Institutional Market Surveys

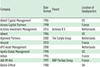

Our regular asset class and country surveys provide a detailed overview of developments in each market, including asset class growth, client breakdown and asset managers’ market share. Data is collected from leading global managers and include our European institutional league table, with aggregated mandate by asset managers from European pension funds and insurance companies.

The team complements each survey with In-depth commentary and visual content.

In this section, users will find up-to-date summaries of our latest asset class and country surveys, which provide the headline data and highlights. Subscribers will find the full datasets, including detailed strategy level data and information.

Latest IPE surveys

IPE institutional market survey: Investment grade credit managers 2026

European institutions have been stockpiling investment grade credit, according to this year’s survey of assets held in IG credit strategies. The headline figure for the European institutional segment shows a 27% increase from last year’s survey to €1.63trn.

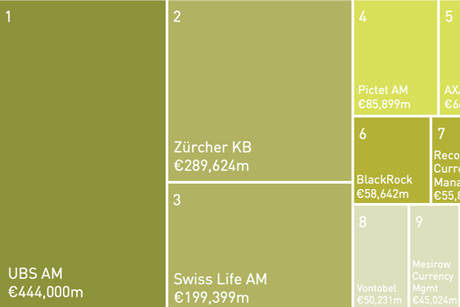

IPE institutional market survey: Managers of Swiss institutional assets 2026

Domestic managers top our ranking, in terms of AUM, of the leading managers of Swiss institutional assets. However, UBS Asset Management is the undisputed leader, following the acquisition of Credit Suisse by UBS, and the onboarding of Credit Suisse’s institutional clients.

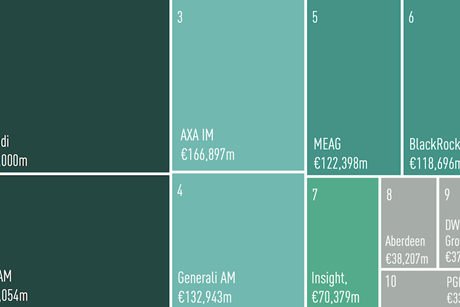

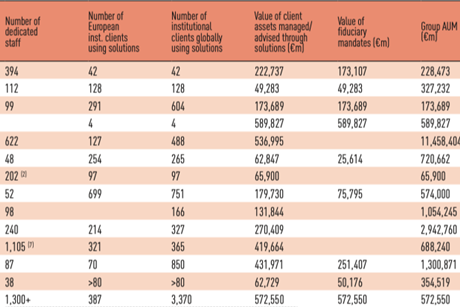

IPE institutional market survey: Fiduciary, OCIO & outsourcing 2026

IPE’s annual fiduciary management, OCIO and outsourcing survey covers packaged advice and implementation services provided by investment management or consultancy firms to institutional investors.

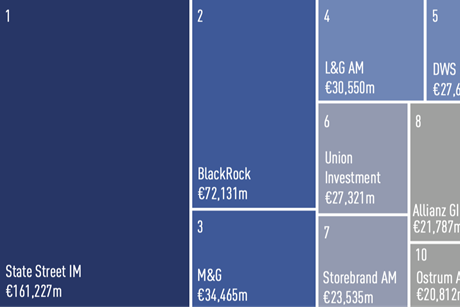

IPE institutional market survey: European equities managers 2026

Our analysis shows a structural decline in the European institutional market share in the European equities asset class in the last eight years, despite a brief post-COVID rebound in appetite.

IPE Quest Expectations Indicator

IPE Quest Expectations Indicator - February 2026: confidence inspires risk-on behaviour

With inflation seemingly under control, and the threat of trade war retrenching, the prospects for equities are positive across the board

IPE Quest Expectations Indicator – January 2026: Equities win managers’ vote

The pessimism around equities prevailing last summer has evaporated

IPE Quest Expectations Indicator – December 2025: Uncertainty receding

With Trump losing support domestically, the economy is expected to growh

IPE Quest Expectations Indicator – November 2025: Exuberance re-visited

Global equity optimism rises despite political turmoil and supply-chain risks

IPE Quest Expectations Indicator – October 2025: Views converge amid uncertainty

Though very few analysts expect equities and bonds to fall across the board, with the exception of Japan, the ‘neutral’ vote is very high

IPE Magazine January/February 2026

Read the latest issue of IPE Magazine

Browse the digital edition and find highlights from this month's issue below

Digital edition of IPE magazine

IPE institutional market survey: Private equity managers 2025

IPE’s annual survey of private equity firms, highlighting their assets under management, fund raising, and the areas in which they invest

IPE institutional market survey: Global equities managers 2025

European institutional investors hold just shy of €2trn in global equities, up from €1trn in 2022. The assets held in global equities by European institutions have nearly doubled, no doubt thanks to the meteoric rise of equity valuations in the post-COVID years.

IPE institutional market survey: Managers of Nordic institutional assets 2025

The assets managed on behalf of Nordic institutional investors have grown handsomely since the 2022 trough, increasing by almost 57%, while those managed on behalf of Nordic pension funds have grown by 50% over the same period.

IPE institutional market survey: Managers of Dutch institutional assets 2025

The assets managed on behalf of Dutch institutional investors have grown for three consecutive years, approaching the highs of 2022. APG, the managers of the government employees’ pension fund ABP, tops the AUM ranking.

IPE institutional market survey: Emerging market debt managers 2025

Total assets in emerging market debt managed on behalf of global investors have been volatile in terms of size.