Analysts expect equities prices to rise in both EU and US, and similarly bond prices to fall in both jurisdictions

Political risk

Now that the US plan for peace in Ukraine has been unveiled, the ball is in Russia’s court, but Putin’s irrational character means that EU enterprises lining up for the peace bonus may well be disappointed.

Meanwhile, Trump is losing support domestically and could become a sitting duck even before the US mid-term elections.

Asset allocation

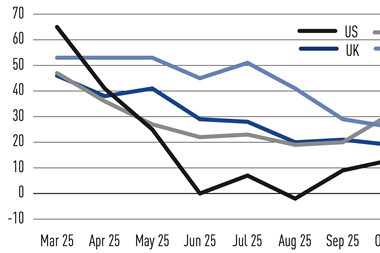

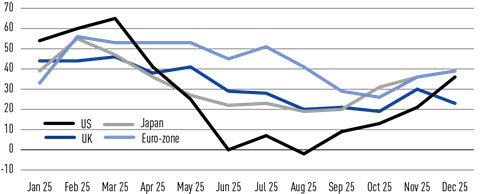

Net equity sentiment statistics are generally up, except in the UK, so that market is now the outlier. It seems like markets are predicting that as long as Trump is incapacitated, the economy will grow. This means analysts expect no autonomous growth in the UK. Yet, the UK is marching along the NATO countries that are massively increasing military spending, while the UK has a strong defence industry, well positioned for exports to the EU and even more so to Ukraine, in case peace should break out.

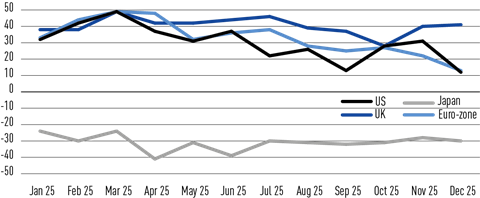

Net statistics on EU and US bonds are drifting slightly down, but once again stable in Japan, and mounting in the UK. The net expectations for US and EU bonds are now at a 12-month low.

In the EU and the US, the neutral vote is down for equity, up for bonds, making the position of both markets largely comparable. In Japan, uncertainty is receding for both equity and bonds. By contrast, UK analysts left the uncertainty numbers practically unchanged since last August.

Country allocation

A steep drop for US bond expectations and another rise in equity expectations has brought the EU and US in a similar position, with Japanese equity expectations following suit. The UK is a clear outlier, with a stable preference for equities, but a rising preference for bonds. It is not clear what this pessimism is based on.

Net sentiment equities

Net sentiment bonds

Click here to download the complete PDF

Peter Kraneveld, international pensions adviser, PRIME bv

Supporting documents

Click link to download and view these filesIPE Quest Expectations Indicator – December 2025

PDF, Size 0.38 mb