- Changes in market regimes are helping the rise of dynamic asset allocation

- Developed market assets have been more favoured

- Strategic and dynamic asset allocation are complementary

- The outcomes so far have been favourable

This insight, which allows new information to guide one’s opinions and plans, has been taken on board by pension plans, as their strategic asset allocation has become ever more exposed to the economic rollercoasters that have whipsawed their portfolios recently. Dynamic asset allocation (DAA), an active investment strategy that adjusts a portfolio’s mix of assets based on changing market conditions, has been on the rise to protect the downside and capture the upside.

These are among the findings of the 2025 annual pension survey in a research programme first started in 2014 by Amundi Investment Solutions and consultancy CREATE-Research.

This year’s survey aims to show how pension plans globally are using strategic and dynamic asset allocation in tandem when faced with non-linear interconnected risks with no historical precedence to guide them.

“When facts change, I change my mind”

John Maynard Keynes

Dynamic asset allocation is predominantly perceived by survey respondents as a pragmatic periodic deviation from investors’ strategic asset allocation (SAA) in response to changing financial regimes, market conditions and asset valuations. It relies on a forward-looking approach – based on maths, models, skills and technology – used mostly in periods of high volatility.

This approach is as much about mitigating newly emerging risks as about profiting from short-to-medium-term opportunities from dislocations, especially when markets transition to new regimes during which mispricing of assets is rife.

It seeks to benefit the portfolio via tactical changes to the asset class mix set by SAA based on asset-liability modelling, which has long been the cornerstone of pension portfolios.

Thus, the two approaches mostly complement one another: the strategic one focuses on the asset mix and overarching goals within a disciplined framework; the dynamic provides essential guardrails during market upheavals using a portfolio manager’s skills, while also helping to mitigate the impact of structurally higher inflation and benefiting from the recovery phases. Notably, since the bear market of 2022-23, many survey respondents felt obliged to focus on period-by-period returns in their SAA.

Current status and future drivers

As figure 1a shows, 73% of respondents now use DAA to varying extents. This figure is likely to rise to 84% due to the identified market drivers (figure 1b), according to our data. Small and medium-sized pension plans rely on external asset managers using either multi-asset dynamic funds or the outsourced CIO model. Larger plans, with the right governance and expertise, are moving towards the total portfolio approach, via dynamic pivots over a wide opportunity set to meet their funding goals. This approach directs the in-house full-time investment team to set the strategic stance of the portfolio, resulting in more dynamism and leaving the governing board to provide the policy guidance and its oversight.

In any event, DAA gained extra momentum as key central banks started their aggressive rate-hiking cycle during 2022-23, which rapidly ended the long era of suppressed volatility that had favoured SAA. Lately, the shift has received fresh impetus from a raft of new policy measures in the US, ranging from penal reciprocal import tariffs fuelling inflationary fears to big tax cuts forcing up interest rates in future.

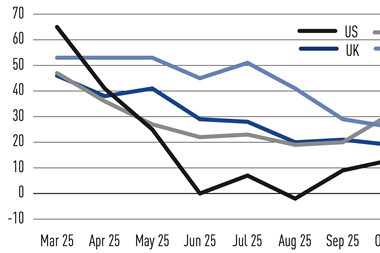

As the survey shows, 83% of respondents see these US measures as the main driver of capital markets over the next three years. Scenarios of their outcomes vary, with significant right and left fat tails, mostly the latter. A glimpse of how choppy the markets can get was evident from the crash following the so-called ‘Liberation Day’ last April that saw the imposition of US tariffs. The S&P 500 index, Treasuries and the dollar took simultaneous hits, reminiscent of 1970s stagflation.

In the subsequent rally, US stocks were priced for the most optimistic of results, according to survey respondents. They believe that the lack of clarity on the impacts of policy measures – and the subsequent reversals – was one contributory factor. Another behind the current euphoria is simply investors’ fear of missing out on the latest rally. Thus, US exceptionalism is under the spotlight.

Real concerns

That apart, there are real concerns that the inexorable rise in public debt in pursuit of strategic autonomy amid global turbulence in the key economies may force up interest rates before long. Governmental attempts to lower them by fiat – as was tried in the US in 2025 despite rising inflation – risk eroding the independence of central banks and igniting inflationary expectations. Survey respondents now demand a higher risk premium on US assets, duly backed by dollar hedging after the greenback posted its worst first half-year performance in 2025 since 1973. Respondents are also diversifying internationally.

A new era of financial repression is likely with rates being kept artificially low to manage debt and erode its real value via rising inflation. That story rarely ends well for investors, as history shows, when asset prices are shaped less by the real economy and more by political impulses. DAA has been the response – for now.

Impacts and outcomes

When asked to what extent these drivers imply more frequent changes in the market regime, 12% said not at all; 59% said to some extent; and 29% said to a large extent (figure 2a).

Their impact on pension portfolios will be evident in two ways (figure 2b): a rollercoaster ride for capital markets (59%) and shorter and frequent business cycles (49%). Both dictate the need to protect portfolios from sizeable drawdowns (56%) and capture the upside potential of specific assets (34%). So, for survey respondents, the near-term story is one of risk minimisation over return maximisation.

Hence, DAA is meant to take account of the recursive nature of risk and return, as systemic risks continue to rise. In the process, it targets multiple goals to: provide meaningful diversification across market cycles; align with changing pension liabilities; maintain portfolio liquidity to meet fast-maturing pension obligations; and target enhanced risk-adjusted returns.

Favourable outcomes

So far, survey respondents report favourable outcomes on two counts. First, for the majority of respondents, DAA has made portfolios more resilient in the face of market turbulence (figure 3a). Resilience has been measured by the variability of returns, value at risk or maximum drawdown.

The second count compares ex post outcomes in relation to ex ante expectations (figure 3b): 63% report positive outcomes in line with or above expectations.

Three contributory factors have been identified by the respondents. First, they had nimble governance that empowered full-time executives to make speedy decisions. Second, they had a talent pool well versed with investing across market regime changes. And, third, they had access to best-of-breed external asset managers experienced in dynamic investing.

Future prospects

On a three-year forward view, the regime change implied by identified macro drivers is likely to create favourable opportunities (figure 4a): 18% said to a large extent, 57% to some extent and 25% not at all.

Further, it is evident that our survey respondents plan to take advantage of emerging opportunities (figure 4b): 14% to a large extent, 61% to some extent and 25% not at all. Both caution and pragmatism will likely prevail, with downside protection prioritised over upside returns, duly allowing for path dependency – returns in any period can be influenced by those in the preceding ones due to momentum.

A variety of tools and asset classes are likely to be deployed within a modified version of the core–satellite model but with blurred internal dividing lines.

The core is expected to cover the passive strategies most suited to informationally efficient markets. The satellites will cover active strategies to exploit market inefficiencies. They will include multi-asset dynamic funds that mix asset classes in a single vehicle to deliver all-in-one outcome-orientated solutions that aim to protect funding status.

Derivative overlays – hedging commodity, equity, FX, inflation and interest rate risks – are also included in this group. They serve to hedge out various risks – such as equity, interest rate, inflation, currency and commodity – without deviating from asset weights in SAA while capturing the potential upside. They have served to enhance portfolio nimbleness by not having to physically trade in the underlying assets, thereby optimising cash utilisation with less upfront capital to reach strategic targets.

As for the specific asset classes to be deployed within the core-satellite model, the overall emphasis may well shift towards value stocks that have long remained unloved and undervalued, while growth stocks – mostly in the AI sector – have hit fresh peaks via huge expansions in multiples. In time, they will need steep increases in earnings to justify current valuations.

Developed market assets, such as those hitherto under the radar in Europe and Japan, will be favoured due to greater liquidity, underpricing and lower volatility.

Emerging market assets, in turn, are likely to be less favoured when it comes to DAA, due to their historical higher volatility and lower liquidity. Their recent rally contains value traps, in part attributed to the falling US dollar last year. Interest will be centred on companies more than countries. The most favoured companies are likely to be those that are able to convert the favourable growth dynamics of their country into attractive growth in earnings per share. This focus on asymmetric upside applies especially to companies in China where the chronically high savings ratio, the unproductive investment glut and stretched local government finances are now weighing on economic growth.

Opportunism is likely to focus on US assets in the near term – duly dollar hedged – until the impacts of the recent policy measures become more visible. For the near term, they will likely retain ‘there is no alternative’ status. Their Capex and corporate profits look strong. The inflated value of the so-called Magnificent Seven tech stocks reflects big earning power, but there are risks that if the US Federal Reserve loses its independence, inflation expectations will be reignited and emerge as a distinct driver of rising prices in their own right. With the yield curve getting steeper, the discounted future profits of those tech stocks, which include Microsoft, Nvidia and Tesla, could take a big hit.

Hence, three imperatives will feature highly in the dynamic asset allocation programmes of our survey respondents.

The first is resilience, by targeting assets with in-built shock absorbers to survive volatility bouts. Second is efficiency, by making an informed choice between overlays and asset classes. And third is liquidity, by seeking bargains during periods of significant asset mispricing.

Concluding remarks

DAA has moved from the periphery to the mainstream and revealed pension governance and investment expertise as the alpha behind alpha in evolving markets. DAA will prevail at least until the fog of uncertainty lifts on the new world order while the old one that long relied on risk models based on past price behaviours is being upended.

Monica Defend is head of the Amundi Investment Institute; Vincent Mortier is the group CIO at Amundi Investment Solutions; and Amin Rajan is CEO of CREATE-Research