Caroline Hay

Analysis

AnalysisChart watch: oil price, German construction PMI, Chinese consumption

Markets remain relatively unfazed by recent geopolitical events, thanks to the loose financial conditions globally

Analysis

AnalysisMacro focus: demand for rare earths to rise as countries increase protectionist measures

China’s sudden imposition of sweeping restrictions on rare earth exports took place alongside violent moves in stock markets

Analysis

AnalysisMacro focus: the new shape of economic recovery in the post-Covid world

The effects of the global recession caused by the response to the COVID-19 pandemic are lingering, as seen by the uneven patterns of consumer spending

Features

FeaturesAnalysts push back on rate cuts

Federal Reserve chair Jerome Powell’s June press conference was, like most careful central bank-speak, open to interpretation. It was possibly slightly dovish with a hint of hawk. However, in the aftermath of the press conference, and following a few busy days of US economic data releases, many analysts have pushed back their forecasts for the number of interest rate cuts this year.

Features

FeaturesMarket predicts US soft landing - June 2024

A combination of Federal Reserve chair Jerome Powell’s press conference and a slightly weaker-than-expected US April non-farm payrolls outcome succeeded in flipping the market back to a soft-landing narrative for the US economy. US Treasury bonds rallied sharply, taking other markets with them, while the yen weakened significantly against the dollar before recovering.

Features

FeaturesReluctance to drop interest rates disappoints the markets

US rates markets entered the year enthusiastically pricing in over 160 basis points of cuts through 2024, and have since had to push back hard on both the timing and magnitude of interest rate cuts now expected by year-end.

Features

FeaturesContrasting global economic growth fortunes

Economic growth patterns across the world paint a picture of contrasts, ranging from surprisingly robust in the US to soft and struggling in China, with the stagnant euro area narrowly avoiding a technical recession after posting zero GDP growth in the fourth quarter of 2023, following a 0.1% decline the previous quarter.

Features

FeaturesConflict and elections set to dominate the investor landscape

Middle Eastern tensions are running high, with violence flaring up across the wider region. Combined with the ongoing attritional destruction in Ukraine, this is impacting world trade, and it seems certain that international conflict will continue to be a source of great concern in 2024.

Features

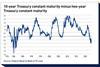

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

Features

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

Features

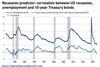

FeaturesCredit investors ready for a possible US recession

Although 2023 has been ‘interesting’ so far, it has also provided relief after the challenges and financial asset mayhem of 2022, and a wide range of asset classes have posted positive returns to date.

Features

FeaturesFixed income, rates & currency: Lean times to follow good summer?

The macro-economic news in the third quarter has been good, with better growth than expected and better inflation data than feared. In the final few months of the year, however, markets may have to deal with the potential for some softer economic news and possibly more negative inflation data, and not just from seasonal factors.

Features

FeaturesFixed income, rates & currency: US debt crisis averted – what next?

The US debt ceiling crisis was resolved in June, avoiding potentially major fireworks, with a suspension of the limit until early 2025. This ensures that the next time the politicians have to fight about it will be after the November 2024 presidential election. Although markets were relieved at the temporary resolution, the process of rebuilding the very depleted Treasury cash balances – with some huge bill auctions planned – will drain significant liquidity from the system, which could put pressure on the rates market.

Features

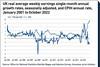

FeaturesFixed income, rates & currency: Strong labour markets surprise

Global purchasing managers’ index (PMI) data, which measures the state of the US economy, has been mostly strong, although manufacturing indices have been considerably weaker than services, perhaps reflecting their greater sensitivity to higher interest rates.

Asset Class Reports

Asset Class ReportsFixed income – New beginning for bond investors

A painful 2022 for fixed income means attractive opportunities and a possible normalisation in risk and return

Features

FeaturesFixed income, rates & currency: Optimism fades on mixed data

January’s market optimism has been subsiding, as forecasts for inflation and US Federal Reserve policy shift the outlook further to the hawkish side. However, the macro picture is not clear. Markets hang on to every new piece of data to clarify the outlook, be it non-farm payrolls, the consumer price index (CPI) or the US Job Openings and Labor Turnover Survey (JOLTS).

Features

FeaturesFrom soft landing to no landing

Once again, the US jobs market has shown its capacity to surprise forecasters, if not astonish them. January’s non-farm payroll numbers came in way above consensus forecasts, swiftly reversing markets’ dovish take on that week’s central bank actions, with bond markets handing back much of their earlier gains.

Features

FeaturesIs the US heading for a soft landing?

Rare though they are in history, a soft landing for the US economy seems to be the consensus forecast, a view aided by news of a sharp contraction in the Institute of Supply Management (ISM) Services Purchasing Managers index in December. The jobs market also looks like it is slowing down and there are signs of a cooling off in wages, with lower-than-expected average hourly earnings reported in December’s non-farm payroll report.

Features

FeaturesFixed income, rates & currency: Inflation strengthens its grip

Whereas news of the hostilities in Ukraine may be losing their potential to shock and dislocate the world economic order, inflation news has maintained its powerful hold over financial markets across the world throughout 2022, with many economies recording their highest inflation levels for decades.

Features

FeaturesUS dollar strength and the issues facing institutional investors

Most central banks across the world are raising interest rates – some more aggressively than others – but it is proving hard for any of them to out-hike the US Federal Reserve. The resulting widening interest rate differentials have been an important factor in the appreciation of the US currency.