Investors show renewed exuberance across regions, but political shocks and supply disruptions test confidence in equity and bond markets

Political risk

Donald Trump’s approval rating is at a record low for his second term. As before, he scores lowest on economic and financial issues and is generally blamed for the government shut-down. With the US now embroiled with itself over the budget and creating higher levels of enmity with allies like Canada and India, the risk that the US spins out of control of the ruling party has increased. Companies depending on imports and those with or being complicated distribution networks are most at risk.

In the EU, China is threatening Nexperia, the Dutch market leader of chips used in cars. VW has already announced a production stop of its Golf line of cars due to chips being unavailable.

Deliveries of arms from EU countries and the UK to Ukraine have increased significantly, with the UK, the Netherlands, Germany, and the Nordic states at the forefront. The surge is centred on drones and air-defence systems. Vladimir Putin’s tactic of provoking drone incursions over NATO territory is failing. It has prompted heightened readiness, but not a diversion of arms from Ukraine – a sign that the risk of escalation remains contained, in spite of Putin’s renewed nuclear sabre-rattling.

Asset allocation

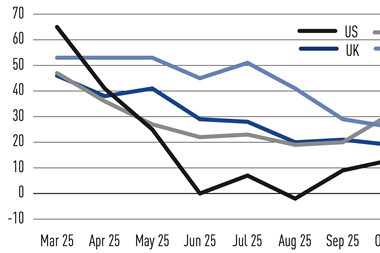

Net equity sentiment statistics have become more positive in all regions, with the US slightly trailing the others and the EU catching up with Japan. While the numbers are far from extreme, it is not clear what this general optimism is based on. The neutral vote being higher than usual says that the views expressed are subject to considerable uncertainty.

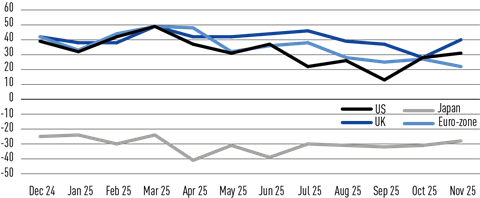

Net bond statistics are drifting slightly apart, with only EU bonds’ sentiment worsening somewhat. On a longer term, bond sentiment has been largely unchanged in the last six months. Uncertainty may very well also play a key role in the bond market.

The neutral vote remained at a very high level in all regions. The equanimity of US bond analysts looks out of sync with the political pressure on the Federal Reserve to lower interest rates. Perhaps extreme views cancel each other out.

Country allocation

The analysts of English-speaking countries prefer bonds, while equity is preferred in the EU and Japan. This could be a nice diversifier for those who do not have a clear opinion or a speculative opportunity for those who have a firm view on the short-term future. With the exception of EU bonds, all statistics have moved up. This is certainly exuberance, but is it irrational?

Net sentiment equities

Net sentiment bonds

Click here to download the complete PDF

Peter Kraneveld, international pensions adviser, PRIME bv

Supporting documents

Click link to download and view these filesIPE Expectations Indicator - November 2025

PDF, Size 0.59 mb