All Alternatives articles – Page 9

-

Country Report

Country ReportNordic region: Interview with Richard Gröttheim, AP's outgoing CEO

Richard Gröttheim, AP7’s outgoing CEO tells Pirkko Juntunen about a pension system that many countries are keen to learn from

-

Opinion Pieces

Opinion PiecesViewpoint: Asset allocation – factoring inflation

As inflation keeps beating records, real incomes remain under pressure and the standard approaches to diversification are challenged

-

News

To rebalance or not? Dutch pension funds face dilemma as illiquids exceed limits

Bpf Bouw will sell close to €3bn in hedge fund investments and is also reconsidering its private equity and real estate holdings

-

Country Report

Country ReportSwitzerland: Pension funds edge towards alternative investments

Swiss pension funds are cautiously but decisively taking steps to build a portfolio of alternative investments

-

Asset Class Reports

Asset Class ReportsPrivate markets: Is tokenisation a good idea?

Digital tokens are being promoted as a way for small investors to access private assets

-

News

NewsAustrian Pensionskassen cut equities, up alternative investments in H1

Austrian Pensionskassen returned -8.78% in the first half of this year, down from 7.63% recorded in 2021

-

Features

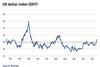

FeaturesFixed income, rates & currency: Central banks act tough

This year’s Jackson Hole Symposium, an annual high-level event sponsored by the Reserve Bank of Kansas, yielded relatively little policy news. But the fighting talk from the US Federal Reserve and others was striking. Fed chair Jerome Powell’s speech was markedly more hawkish than expected, while Isabel Schnabel, board member of the European Central Bank, referred to the need for central banks to act ‘forcefully’ because “both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high”.

-

Features

FeaturesMarket overview: German institutional investors manage uncertainty

At mid-year 2022, the volume of Spezialfonds – the German vehicle for professional investors – administered on Universal Investment’s platform was €498bn, a rise of around 5% year on year. On a six-month basis, however, and compared with the end of the booming stock year 2021, asset volumes were down around 3%.

-

Opinion Pieces

Opinion PiecesViewpoint: Five myths about alternative investments

Alternatives can help investors pursue their goals by being a source of new opportunities

-

News

Pension funds ratchet up search for private market alternatives

At the same time new searches for listed equity and bond managers fell to new lows, with the exception of EM

-

News

NewsSwiss Pensionskassen continue to bump up infrastructure investments

More than a quarter of pension funds plan to increase allocations to infrastructure and 69% plan to maintain their current strategic allocation intact

-

News

NewsItalian pension schemes to further increase exposure to alternatives

Majority of industry-wide pension funds (88%) is investing through mandates this year, up from 79% last year

-

News

Alecta loses international real assets chief to Heimstaden

Sweden’s biggest pension fund says Heijbel was key part of its work to grow the real assets portfolio

-

News

NewsFCA issues warning to alternative investment bosses via open letter

For the UK’s status to be retained, its markets must remain clean, liquid, and orderly, letter states

-

News

Poll shows 10 percentage-point rise in ESG use by alternatives investors over 3 years

Two thirds of European investors in private equity, infrastructure, now have climate policies compared to less that a quarter of their US peers, new survey shows

-

News

NewsGerman doctors’ scheme ÄVWL returns 18.1% with alternative Spezialfonds

Allocations in Spezialfonds amounted to around 68.8% of the scheme’s total assets

-

News

West Yorkshire Pension Fund to use derivatives ESG risk framework

Framework will be used to build an ESG-aware derivatives overlay as fund gradually builds its portfolio of illiquid, alternative assets

-

Country Report

Country ReportCountry Report – Pensions in Italy (July/August 2022)

Italy’s pension industry continues to develop, albeit at a slow pace. Italian pension funds are adapting their strategies to the volatile and uncertain market regime, by purchasing inflation-linked assets and by taking advantage of potentially higher yields on domestic government bonds. However, as our lead article highlights, they are generally staying true to their long-term diversification strategies, which consist of gradually allocating to alternatives including private equity, private debt and infrastructure. Some have bought shares in the Bank of Italy, a private equity-like investment.

-

Country Report

Country ReportItaly: Pension funds adapt to a new regime

Inflation, higher interest rates and geopolitical tensions are leading Italian pension funds to recalibrate their investment strategies

-

Features

FeaturesFixed income, rates & currency: inflation battle in full swing

As we reach the midpoint of the year, there is little sign that the second half of 2022 will be any less turbulent than the first. The conflict in Ukraine slogs on – a destructive war of attrition, pain and fear. The repercussions are huge, global and unpredictable, be they surging energy prices or impending, but acute, shortages of basic foodstuffs, or of semi-conductors, so vital to 21st century life.