All Alternatives articles – Page 7

-

Special Report

Special ReportSumitomo Mitsui Trust's Yoshio Hishida on Japan's unique position to attract investment

Yoshio Hishida, CEO of Sumitomo Mitsui Trust Asset Management, one of Japan’s largest investment managers, talks to Christopher Walker about his company’s focus on retail and attracting international capital

-

Features

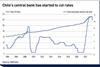

FeaturesFixed income, rates & currency: Uncertainty persists

As the major central banks in developed markets reach, or at least near, the end of their hiking cycles, markets, rather than identifying when policy rates will peak, focus is now on the conundrum of just how long these policy peaks will be maintained.

-

News

NewsSweden’s tech-heavy AP7 trumpets 17.7% first half return

Buffer fund AP2 lags peers with 4.8% H1 gain; pensions firm Folksam reports 5.6%

-

News

NewsIlliquids balance blamed, as ATP loses most of Q1 gains

‘Always thinking about alternatives-liquids balance’, says Danish statutory pension fund CEO on asset mix of geared investment portfolio

-

News

NewsAPK Pensionskasse tactically increases allocation to alternatives

Alternatives now make up 12% of APK’s investment portfolio

-

News

NewsUnicredit pension fund closes down alternatives sub-funds

The fund for alternative investments Effepilux Sif-Sicav fund will become a real estate Alternative Investment Fund (AIF)

-

News

NewsVarma trounced by rival Ilmarinen in first half

Finnish pensions heavyweight reports 2.6% return in first half

-

News

NewsGerman doctors scheme boosts allocations to alternatives

The pension fund has increased allocations in private equity, private debt and infrastructure

-

News

NewsMSCI to buy private markets data firm Burgiss

Burgiss dataset covers over 13,000 private asset funds around the world, representing $15trn in cumulative investments

-

News

NewsFondo Gomma Plastica eyes private equity secondary investments

Rubber and plastic fund chief sees private equity opportunities in the US as the Milan-based fund makes a further pivot to alternatives

-

News

NewsLD Pensions seeks managers for estimated €268m of alternatives

Danish pensions manager offers mandate to invest in listed alternative securities

-

News

NewsGermany’s KENFO plans slight increase in illiquid assets

The fund took tactical measures to cushion losses in 2022 that stood at the end of the year at -12.2%

-

News

NewsNordic roundup: Industriens posts 3.3% in H1, Sampension sees weaker H2

Sampension CIO says second half of 2023 could well be weaker than the first, as market positivity overblown

-

News

NewsDanish FSA raps ATP and other pension funds over alternatives valuation

Pension firms must ensure necessary value adjustments take place sufficiently quickly and frequently, says FSA

-

Features

FeaturesFX in waiting mode after lively 2022

After a long period of muted volatility, currency markets sprang back into action in 2022 as geopolitical risk and diverging monetary policy came to the fore. This year it is quieter, but markets remain rattled over the unpredictable interest rate scenarios. As a result, many market participants are waiting for a sharper picture to emerge.

-

Country Report

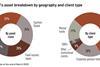

Country ReportItaly: Private markets allocations at a crossroads

Italian pensions funds are showing renewed interest in fixed income, as investment in private markets slows down – but long-term commitments are still in place

-

Features

FeaturesAhead of the curve: The rise of multi-manager models for alternative investing

Fifteen years after the ‘global financial crisis’, multi-manager strategies for alternative investing have not only shaken off their tarnished reputation but have evolved

-

Special Report

Special ReportOutlook – Europe and the world: US overtakes Europe in clean-energy production

Incentives package for US-based clean energy investments is seen by some as a threat to Europe’s industrial competitiveness

-

News

NewsMonaco’s sovereign wealth fund invests in plastic circularity strategy

The SWF invested in Lombard Odier’s new Plastic Circularity strategy which will target key themes including collection and sorting infrastructure

-

News

NewsItaly roundup: Previndai ups exposure to corporate, government bonds

Plus: Eurofer pushes on with direct investments