Asset Allocation – Page 58

-

Features

FeaturesAhead of the Curve: The mega-cap conundrum

Last year was challenging for quantitative equity strategies with a large proportion of them underperforming their benchmark on a rolling one-year basis. There has, therefore, been a great deal of interest in understanding the shortcomings of quantitative portfolios over the same calendar year.

-

Features

FeaturesFixed income, rates, currencies: Global economy under pressure

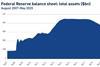

At the end of February, after a week that saw stock markets around the world plummet, US Federal Reserve chair Jerome Powell sought to calm fears, saying that the Fed would “act as appropriate” to support growth.

-

News

VER plans up to €1bn commercial paper investment

Finnish fund to ease firms’ funding by buying their short-term debt gradually and on market terms

-

News

Icelandic pension plans halt foreign investment during corona crisis

Country’s export revenues projected to decline temporarily

-

News

AP4: Unlisted build-up will be gradual as Sweden stamps reform

Bill passed by all parliamentary parties except Left Party

-

News

NewsDutch pension funds stick to rebalancing policy

Trustees prefer to stick to their policy because of their pension schemes’ long-term focus

-

News

KLP and DNB join forces to invest NOK12bn in renewables debt

Partnership seen giving both Norwegian investors a good position to secure deals

-

News

NewsChinese insurers pick Redington’s analytics platform

The first two clients to benefit from YuYuan’s products and services

-

News

Danish pension firms pile on alts, as unlisted shares beat listed

Nearly a fifth of the sector’s total investments now in unlisted assets

-

News

NewsActivist groups campaign against Australian supers’ fossil fuel holdings

UniSuper should be leading investor action on climate change

-

-

-

-

Features

FeaturesAhead of the Curve: The trade war and Asia

The rivalry between the US and China looks set to dominate Asian affairs in the future and cannot be ignored by responsible investors. The escalation of tensions at the start of Donald Trump’s presidency led to an increase in trade barriers and impacted growth; now a temporary truce has been agreed but uncertainty remains, as do tariffs on Chinese exports to the US. The new bilateral agreement is a positive step, but investors should take a long-term view; the economic and strategic rivalry looks set to continue and some sectors are better placed than others to adapt to this landscape.

-

Analysis

AnalysisFixed income, rates, currencies: China’s woe hits rest of world

While the speed and breadth of the spread of infection was unknown, it was apparent that the outbreak of the new coronavirus, named COVID-19 by the World Health Organization (WHO), would cause considerable disruption to economic activity in China.

-

Country Report

Country ReportNetherlands: Still searching for yields

Dutch pension funds are looking towards illiquid assets as they search for returns in the challenging low-interest-rate environment

-

News

Natixis: Korean asset owners seek higher returns abroad

Korean pension funds have become ‘very aggressive’ in their hunt for returns

-

News

NEST stays cautious despite positive 2019 returns

Good performance across high yield bonds, emerging market debt and equity, similar numbers not expected for 2020

-

News

PwC: Dutch schemes invest largest stake abroad

Foreign holdings of Dutch pension funds increased by six percentage points

-

News

NewsWestminster scheme weighs renewable infra move

Adviser recommends at least 5% allocation to illiquid alternatives and extra 5% in fixed income