Asset Allocation – Page 55

-

News

NewsSwiss schemes pushed to adopt riskier strategies amid crisis uncertainty

Swiss pension funds will need to pursue riskier investment strategies in a hunt for higher returns in a prolonged period of low interest rates and amid the consequences of the COVID-19 pandemic. “Hunting for yield is costlier and harder to do for pension funds, as for other investors,” Jackie ...

-

News

Publica to increase stake in firms with renewable energy ‘high-quality patents’

It has excluded investments in the coal sector, preferring renewable energies, wind farms or photovoltaic systems

-

Opinion Pieces

Opinion PiecesViewpoint: Majority of DC schemes not ready for illiquid assets

But the outlook for change may be positive

-

News

NewsUK’s NEST adopts net-zero policy, skips on UN group over fee

DC provider to shift £5.5bn-plus assets to ‘climate aware’ fund

-

News

bfinance: satisfied investors still plan risk management changes

82% are satisfied with overall portfolio performance, with just 25% changing their strategic asset allocation in 2020

-

-

News

Sovereign investors take advantage of COVID-19 buying opportunity

SWFs aim to increase allocations to fixed income, private equity and infrastructure

-

Opinion Pieces

Opinion PiecesViewpoint: Investing after the Corona Slump

What are the facts that we know and that we can rely on when thinking about portfolio construction?

-

News

LD Pensions picks Acadian for first active quant mandate

Early holiday allowance payouts makes eventual allocation more uncertain, says equities chief

-

News

Strathclyde backs new life sciences venture fund

‘This is an equity investment which balances our portfolio in terms of diversification’

-

News

£900m in new UK pension allocations to climate-tilted tracker funds

UBS UK’s DC scheme and Tyne & Wear DB scheme invest in UBS AM, LGIM funds

-

News

bfinance sees ‘fundamental shifts’ in Chinese equity offerings

Consultancy says clients increasingly using dedicated China equity strategies

-

-

-

Features

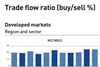

FeaturesIPE Quest Expectations Indicator July 2020

Global statistics indicate that while new cases of COVID-19 are rising, case mortality is stable at about 4,000 per day. The situation is in hand, but the danger is not over. First, the Americas, dominated by the US and Brazil, are confronted by rising case statistics. Second, there are signals of a rebound in autumn, both in theory as medical experts embrace the thought and in practice, as the figures in Iran show. Third, the equality protests increase the chances of a second wave.

-

Features

FeaturesAhead of the curve: Liquidity has been the litmus test for China’s bond market

It is no safe haven, but China has provided bond investors with important shelter through the storm

-

Features

FeaturesFixed income, rates, currencies: Dismay sets in

As lockdowns ease, particularly in the northern hemisphere and the Antipodes, economic recoveries get underway. Given the exceptional circumstances, economic forecasts and predictions may show little consensus, or potentially be wrong, the puzzling US payroll announcements for May being a vivid example.

-

Interviews

InterviewsHow we run our money: ENPAB

Danilo Pone, CIO of ENPAB, the first-pillar scheme for Italian biologists, talks about the fund’s new proprietary asset allocation model

-

News

NewsAmundi claims first with EU climate benchmark-aligned mandate

Investment solution developed in response to request for proposal from 12 major French institutional investors

-

News

NewsIceland’s LSR thanks own portfolio construction for COVID resilience

Pension fund giant reveals 3% return by end May, thanking weaker krona and domestic bond bounce