Asset Allocation – Page 54

-

News

German media scheme piles up reserves to invest in infra, alternatives

The scheme turns to illiquids to generate returns

-

News

NewsDanish pensions investors boost unlisted allocations to 27%

Low bond rates have contributed to sector’s unlisted expansion, says central bank

-

News

NewsAustrian pension funds see AUM shoot up to €23.3bn in Q2

Assets increased by 6% for multi-employer pension providers

-

News

NewsSwitzerland gives green light to up schemes’ infrastructure

The change to the regulation for occupational pensions BVV 2, approved by the Federal Council, will enter into force on 1 October

-

-

-

Features

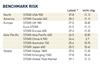

FeaturesIPE Quest Expectations Indicator September 2020

US COVID-19 figures are receding, to the extent that Brazil has taken over as the world’s worst managed country. A number of western European countries are experiencing a minor rebound, likely because of holiday travel. India has suffered a high death toll but this is partly a reflect of its huge population.

-

Features

Ahead of the curve: Alternative data offers insight

The measures required to stop the spread of COVID-19 – social distancing and government-mandated lockdowns – mean that, unlike in previous recessions, services have led the economic decline.

-

Features

FeaturesFixed income, rates, currencies: Still facing anxious times

Developed market government bond yields have spent the summer drifting lower as risk assets traded better. However, this benign climate has not lifted the fog of confusion caused by COVID-19.

-

News

NewsDenmark roundup: LD awards global equities mandate to GuardCap

Plus: Equities, alts weigh on PFA H1 performance; PBU members value responsible, sustainable investment

-

Opinion Pieces

Opinion PiecesViewpoint: COVID-19 and fund secondaries – how should pension schemes position themselves?

How should pension schemes best position themselves to take advantage of portfolio secondary sales opportunities? Are there lessons to be learnt from the GFC for pension schemes selling portfolio positions during COVID-19?

-

News

NewsGerman Spezialfonds see €3.9bn inflows for partial Q2 recovery

Insurers and pension schemes continue to be the main inflow contributors

-

News

PGGM ups stake in joint venture with construction company BAM

Discussions initiated about increasing joint investments in infrastructure

-

News

High hedge fund allocation stunts Varma’s Q2 recovery

Finnish pensions insurance giant sees 5.7% H1 investment loss – falling short of peers

-

News

German church pension fund expands real assets portfolio

KZVK invested a significant amount directly in infrastructure and real estate, particularly in renewable energy infrastructure

-

News

NewsDenmark paves the way for major changes to ATP’s model

Parliament debates bill to change “outdated restrictions” to population-wide statutory pension

-

News

NewsKENFO turns to PE, infra, amid ‘challenging’ return expectations

It’s in the process of building a portfolio based on a step-by-step approach, and hired asset managers to run specialist mandates

-

News

NewsCOVID-19 fuelled unprecedented Spezialfonds flows – study

April flows a ‘dramatic dynamic’, says Kommalpha

-

News

Strathclyde ups cash balance in case of COVID-19 interruption

Year-end cash balance was ‘unusually high’ at the Scottish local government pension scheme

-

News

Virus harms Dutch schemes’ private equity, infra investments

In the first half of 2020, ABP lost 8.1% on private equity, while its infrastructure portfolio returned -5%