The outbreak of the coronavirus in Europe fuelled unprecedented cash flow activity in the German Spezialfonds market in April, with investors withdrawing net €4.5bn despite €24.1bn of fresh allocations, according to Kommalpha.

This constellation of flows did not even arise at the height of the financial crisis, the consultancy said. In January 2008 there were net outflows of €6.5bn, but inflows amounted to a bit more than €10bn.

“The coincidence of fresh money and net cash outflows in the magnitude witnessed in April is unprecedented and a dramatic dynamic in Spezialfonds share transactions,” said Clemens Schuerhoff, managing director of the consultancy.

The activity was mainly driven by insurers, as opposed to pension providers, with the former accounting for €3.1bn of the net outflows and some €5.9bn of the fresh allocations to Spezialfonds. Pension institutions were behind €504m in net inflows after putting €3.3bn of fresh money in Spezialfonds, according to the consultancy’s analysis.

It said it could only speculate as to the liquidity needs of a certain insurance segment, adding that liquidating Spezialfonds for performance or valuation reasons, with subsequent investments in alternatives outside the Spezialfonds wrapper, seemed most plausible.

The situation normalised in May for both insurers and pension providers. The month saw net inflows of €457m.

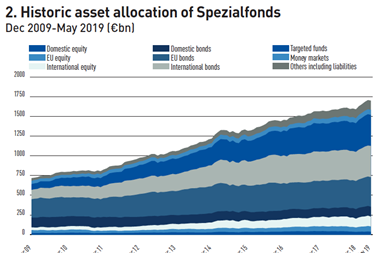

The consultancy’s study was of German insurer and pension provider assets from 2005-2019. It found that these grew from €1.6bn at the end of 2005 to €1.6bn, with funds the most popular investment form for both investor categories (39%).

Pension providers represent the strongest growth segment in fund investments, with their fund holdings growing 398% over the study period. In absolute terms this represents an increase of €337bn, from €87bn at the end of 2005 to €421bn as at the end of December.

The full study, in German, can be found here.

To read the digital edition of IPE’s latest magazine click here.