All Equities articles – Page 21

-

News

NewsNorway’s KLP sees less downside to equities than a year ago

Easier to imagine an improvement in market sentiment in 2023, according to funds department of municipal pensions giant

-

News

NewsLGPS Central seeks active emerging markets equity manager

The pool is looking for active managers that use a fundamental rather than quantitative approach

-

News

NewsInarcassa ups bonds, cuts equities in new strategy

The scheme has also decided to integrate a sustainability element in its latest asset allocation strategy

-

Features

FeaturesAhead of the curve: Is small cap the next mean reversion trade?

By now, most investors have noticed a rebound in value relative to growth in equity markets. After underperforming growth over the past decade, value stocks are experiencing strong mean reversion and outperforming significantly.

-

Opinion Pieces

Opinion PiecesGermany’s equity pension plan raises questions

The current legislative period could bring substantial changes to Germany’s pension system. The government is pursuing reforms to fund first-pillar pensions through a buffer fund invested in equities, although there is little consensus on its feasibility.

-

News

AMF buys AP1’s stake in Swedish electricity firm Ellevio

Parties tight-lipped on deal price, but the 12.5% stake was valued at €135m at end of June

-

News

NewsATP buys 15% of Better Energy for ‘triple-digit million’ DKK sum

Denmark’s largest pension fund snaps up 15% stake in local solar energy firm

-

News

NewsItaly roundup: PreviAmbiente sets up new equity sub-fund

Plus: Inarcassa, Enpav expect positive returns in 2023; INPGI picks alternative investments funds

-

News

Norway’s new northern fund to be separate from sovereign fund, panel advises

Working titles for proposed investment unit are ‘Government New Northern Fund’ and ‘Government Pension Fund Arctic’

-

Features

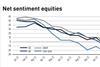

FeaturesIPE Quest Expectations Indicator: December 2022

The Ukrainian offensives look to have petered out and a new initiative will be needed to maintain morale. The US government is once again gridlocked and another debt ceiling fight is likely. The EU seems ready even for a harsh winter, but there are signs of war fatigue. In the UK, Prime Minister Rishi Sunak has apparently learned from the Liz Truss debacle, quickly making the necessary political U-turns, in particular on climate change. Expectations for the COP27 meeting in Sharm El-Sheikh were low. Analyst views indicate increasing belief that the wave of interest rate increases is receding.

-

Special Report

Special ReportProspects 2023: Does zero China make sense?

Many investors are avoiding the People’s Republic, but they would do well to look at the reality

-

Asset Class Reports

Asset Class ReportsAsset class report – Equities

Factor investment strategies were once the ‘new black’ - scientific, quant driven approaches that could deliver the ‘smart beta’ nirvana of lower volatility returns and optimised exposure to robust return premia from small cap, value and quality stocks. Pundits always warned adopters that not all factors would perform all of the time - and indeed they didn’t. But investors are taking a fresh look at factor strategies now the extended spell of outperformance of growth stocks has passed, and value has reasserted itself.

-

Asset Class Reports

Asset Class ReportsEquities – Is tracking error key to carbon reduction?

Passive investors may have to rethink their tracking error limits in the net-zero environment

-

Asset Class Reports

Asset Class ReportsEquities – Factor investment strategies return to favour

After a few years of poor returns from factor investing, investors are again showing interest – but with more realistic expectations

-

Asset Class Reports

Asset Class ReportsEquities – Investing in the midst of Europe’s gloom

Healthcare and luxury brands are two sectors with potential to stand out in an otherwise gloomy macro environment

-

News

NewsDanish teachers’ pension fund to shed €269m of fossil equities

Lærernes Pension tightens criteria for fossil fuel exclusions, after setting 2050 net-zero goal in June

-

Opinion Pieces

Opinion PiecesViewpoint: Asset allocation – factoring inflation

As inflation keeps beating records, real incomes remain under pressure and the standard approaches to diversification are challenged

-

News

NewsAustrian Pensionskassen cut equities, up alternative investments in H1

Austrian Pensionskassen returned -8.78% in the first half of this year, down from 7.63% recorded in 2021

-

News

Luxembourg’s FDC awards MFS €600m active emerging market equity mandate

The strategy’s goal is to outperform the MSCI Emerging Markets index with a controlled tracking error over a full market cycle

-

Special Report

Special ReportSpecial Report – Asia investment

Investors steadily withdrew from emerging Asia equity markets this year, taking nearly $30bn out of the markets in the seven months to the end of July, with six consecutive months of outflows. Tech-oriented Taiwan and South Korea were most affected and India was not unscathed.