The funds division of Norway’s municipal pensions giant KLP has posted an equities commentary saying prospects for rising share values are somewhat brighter now than they were at the start of 2022.

Odd Rune Heggheim, account manager at the mutual fund department of the NOK720.8bn (€67.4bn) Norwegian pension firm’s asset management arm, KLP Kapitalforvaltning, said: “As usual, it is almost impossible to predict what will happen in the financial markets, but if you save for the long term in shares, then there is no particular reason to throw in your cards after what has, after all, been a weak year.

“It goes without saying, but there is less downside now than at the start of 2022, and it is easier to imagine that market sentiment can improve,” Heggheim wrote in the commentary published on Tuesday.

The global economy faced a number of challenges in 2023, he said, including the uncertainty that the Russian invasion of Ukraine was creating in several areas.

It was also uncertain, the KLP equities expert said, how the hikes in interest rates would affect the real economy.

On top of this, he said the Chinese economy appeared unstable and was plagued by the long-term effects of COVID-19, as well as a property bubble that had burst.

“One bright spot is that the American economy appears to be surprisingly robust, with a labour market that has not yet shown any particular signs of weakness,” Heggheim said.

Companies’ earnings had also risen in 2022, he said.

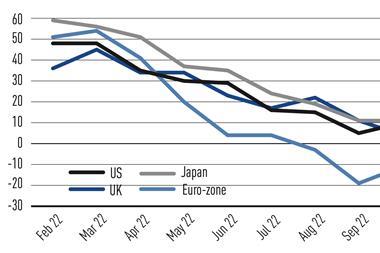

“Since prices have fallen at the same time, the stock markets have become somewhat cheaper in terms of earnings multiples,” said Heggheim.

Regarding inflation, he said it remained to be seen whether the rate of increase in consumer prices would return to normal levels in the course of 2023 and 2024.

With the energy crisis in Europe, precipitated by the disappearance of Russian gas, he said the economic outlook for Europe was weak this year — even though it had been possible to replace Russian gas supplies to some extent with expensive imports from other countries.

“It is more uncertain how much this means for the global stock markets – after all, Europe only makes up around 20% of the MSCI World,” he said.

However, he added, the high prices of gas in Europe had ensured that the Oslo Stock Exchange did relatively well last year.

To read the digital edition of IPE’s latest magazine click here