All Equities articles – Page 19

-

News

NewsAMF lags Alecta in Q1 returns, but lauds ‘well-diversified’ portfolio

Swedish blue-collar pensions firm made 2.9% January-March return in January

-

Features

FeaturesAhead of the curve: What happened to equity volatility in 2022 and what next?

Something strange happened last year. Expectations about the future level of volatility in US equities – implied volatility – behaved in a very unusual way. In a falling market, the price of implied volatility normally rises because equity falls are associated with a worsening macroeconomic outlook, implying more market risk. Expectations of future volatility therefore increase.

-

Features

FeaturesIPE Quest Expectations Indicator May 2023

Russian air superiority over Ukraine is coming to an end due to lack of equipment. Destroying civilian targets is counterproductive and consumes ammunition. Bakhmut is eating into Russian resources, while Ukraine is being re-armed. History teaches that better technology, rather than numerical superiority, wins wars. But even a lopsided Ukrainian win would not automatically mean peace.

-

Country Report

Country ReportUK: Can the country turn a flawed investment ecosytem around?

Decades of complex legislation has fuelled many unanticipated consequences, which has seen pension funds invest less in riskier listed equities and illiquid assets

-

Features

FeaturesFixed income, rates & currency: Chill winds prompt caution

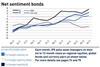

Although 2022 was a remarkably bad year for bonds and equities, any hopes that 2023 might illuminate a brighter path have already been dispelled as rapidly changing narratives – from recession to boom to fears of a banking crisis – all tossed and turned stock and rates markets. The result was a remarkably turbulent first quarter.

-

News

NewsAP4 slashes transport holdings after green-shift fundamental analysis

Swedish state pension fund divests airlines, shipping, and traditional lorries while buying into US rail and niche players in truck freight

-

News

NewsSwiss APK switches emerging market equities benchmark to MSCI Low Carbon Index

The management board has expanded the scheme’s climate strategy

-

News

NewsIlmarinen anchors biggest ETF launch yet

Finnish pensions giant prompts creation of tracker fund based on new MSCI climate index – switching €1.86bn into new ETF

-

News

NewsNorwegian government moves towards adding unlisted equity to SWF

Annual white paper on SWF includes call for more analysis from NBIM on unlisted shares

-

Features

FeaturesIPE Quest Expectations Indicator April 2023

With new, superior equipment, the Ukrainian military is set to start an offensive soon. Meanwhile, Yevgeny Prigozhin, leader of the Wagner Group, is jockeying to become Russia’s next kleptocrat on the back of the Russian army. Donald Trump’s candidacy is increasingly beleaguered by defeats in court. The trade agreement on Northern Ireland between the EU and the UK is a significant boon for both as well as for Prime Minister Rishi Sunak, not because the trade flows are so important but because the issue blocked co-operation in many other fields. While the winter has been mild and beneficial, there are early signs of a dry spring, quite possible in view of climate change setting in. If that materialises, harvests, therefore food prices, will be affected in autumn.

-

Opinion Pieces

Opinion PiecesBanking crisis delivers a lesson on equity strategy

We may never know the precise reasons why the in-house equity team of Alecta, the €105bn Swedish pension scheme, chose to invest in excess of €1bn in risky US banks including Silicon Valley Bank (SVB), much of which has now been written off.

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Investors watch as China corrects course

The Chinese government has managed to restart the economy post-COVID, but investors are cautious

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Slow progress on corporate governance

Equity investors see improvements in corporate governance in emerging markets, but alignment between shareholders, management and owners remains critical

-

Asset Class Reports

Asset Class ReportsEmerging market equities – India’s dancing elephant in the room

Despite challenges with corporate governance and corruption, the prospects for India are too bright to ignore for investors

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy – Emerging market equities

The Adani corporate scandal in India brought the issue of corporate governance in emerging markets back to the fore. As Lynn Strongin Dodds finds, however, emerging market corporates are slowly adapting to the requirements of institutional investors in terms of governance.

-

Opinion Pieces

Opinion PiecesEmerging market investors should take the long view

For institutional investors, investing in emerging markets is a true test of fiduciary duty. The asset class – if it can be defined as such – has enormous potential, yet it is also risky, not just in terms of volatility but also of reputation.

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Rise of the Gulf equity markets

The Gulf region is changing dramatically and provides growing opportunities for emerging market investors

-

News

NewsAP Pension divests further €42m fossil stocks including TotalEnergies, Shell

Danish pensions firm blacklists further 73 companies after tightening fossil fuel exclusion criteria

-

News

NewsAlecta’s board orders immediate strategy probe after US bank losses

Swedish occupational pensions giant says its First Republic Bank investment risks being completely lost too

-

News

NewsSwedish watchdog grills Alecta, others as US bank losses pile up

NBIM ‘closely monitoring the situation in the market’ after €281m exposure to collapsed banks