ETFs – Page 2

-

Special Report

Special ReportCase study: Varma - A bespoke approach to ETFs

Varma, the €57.4bn Finnish pension insurer, has been at the forefront of sustainable investing for several years and has used exchange-traded funds to get there.

-

Special Report

Special ReportCase study: Caja de Ingenieros Gestion - The rise of smart beta

The Spanish pension provider Caja de Ingenieros Gestion serves more than 215,000 members, predominantly from the Spanish engineering sector, using an investment style based on independent analysis, with a bottom-up approach.

-

Special Report

Special ReportFaith-based investing: how to build Shariah-compliant investment portfolios

Ethical investing can be a nuanced task, as aligning one’s investment principles with their beliefs can often be contradictory. On the one hand investors want to maximise their return and minimise their risk to ensure they benefit from the best possible investment outcome. However, on the other hand, they may want to ensure they don’t fund any enterprise which derives revenue from provision of ‘unethical’ goods or services.

-

Special Report

Special ReportCase study: Ilmarinen - Building a climate-focused future

Finland’s second-biggest pension provider is a keen investor in exchange-traded funds (ETFs), having allocated more than €6bn to a range of equity vehicles in recent years.

-

Special Report

Special ReportCase study: How CalSTRS uses ETFs to support the energy transition

The California State Teachers’ Retirement System (CalSTRS) manages US$315.6bn (€294.3bn) on behalf of teachers and education staff in the state of California. Environmental considerations and the transition to a low-carbon economy are high priorities for the pension fund, which is one of the biggest public sector funds in the US.

-

Special Report

Case study: MHPF - Searching for greater transparency

Transparency is one of the most important elements of exchange-traded funds (ETFs) for many investors. For some, however, there is always room for improvement.

-

Special Report

Special ReportInnovation and choice challenge the established players

The wonderful breeding ground of ETFs means that you can now allocate to any sector or specialism you like, from artificial intelligence to recycled gold; export-tilted Japanese companies to carbon credits. New launches this year include Texas Equity, following the fortunes of companies headquartered in the Lone Star State; the euphoniously named Clouty Tune, which brings global exposure to music, entertainment and media; and Breakwave’s Tanker Shipping ETF, which tracks an index for crude oil tankers.

-

Special Report

Special ReportDecarbonisation outcomes: preparing portfolios for a low-carbon world

The climate challenge is clear, and more investors are looking to include climate investing solutions in their portfolios. Next to funding climate solutions and enabling negative emissions, the decarbonisation of portfolios is one of the most important objectives for climate investing.

-

Special Report

Special ReportFocus returns to fixed income ETFs

Fixed income is back, baby! In the seven months to the end of July 2023, flows into European-domiciled fixed income exchange-traded funds were €39bn compared with €14bn for the same period last year, according to Morningstar.

-

Special Report

Special ReportSustainable fixed income products gain ground

Institutional investor exposure to sustainable investment products has declined in recent months as macroeconomic developments have driven a shift back into fixed income products.

-

News

NewsDutch pension funds’ move to segregated mandates knock alternative funds

EFAMA sees gradual shift towards ETFs and index funds

-

News

NewsIlmarinen anchors biggest ETF launch yet

Finnish pensions giant prompts creation of tracker fund based on new MSCI climate index – switching €1.86bn into new ETF

-

News

NewsEuropean roundup: Consolidated tape could attract capital into smaller markets, says EFAMA

Plus: PEPP platform launched by UK technology provider

-

News

NewsUK roundup: The Pensions Regulator to be reviewed by Mary Starks

Plus: Smart Pension adds JP Morgan ETF to sustainable default growth fund

-

Asset Class Reports

Asset Class ReportsEquities – Thematic funds tap into future trends

Themes have long captured the imagination of retail investors. Now institutions are showing interest, despite the lack of clear definitions

-

News

German church schemes opt for passive high-yield strategy, exclude ETFs

The pension funds have switched to indexed products, partnering with Insight Investment and steering away from its active high-yield managers

-

Special Report

Special ReportIPE ETF Investor Survey 2022

IPE’s first survey of investors focusing specifically on ETFs, conducted between mid-July and mid-August 2022, drew responses from institutional investors across nine European jurisdictions, of which 24% were invested in ETFs. Respondents were located in Belgium, Denmark, Germany, Italy the Netherlands, Portugal, Spain, Sweden and the UK.

-

Special Report

Special ReportETFs Guide 2022: Better tax treatment could prompt European ETF takeoff

First the good news: Globally, investment in ETFs continues to surge, with the first half of 2022 seeing the second highest inflows on record. The flexibility and ease of access they offer helped them play an instrumental role achieving the highest volume fixed income trading day being recorded in June, as $58bn of assets were moved from EM debt and high yield into government bonds (see p7). This helped cement ETFs’ position as an essential tool of the fixed income ecosystem.

-

Special Report

Special ReportActive ETFs: five myths debunked

Demand for exchange-traded funds (ETFs) has grown rapidly in Europe in recent years. While much of this growth has been driven by passive funds, research shows that investors are increasingly looking at active ETF strategies. Nevertheless, there are still lots of common misconceptions that are hindering the take-up of active ETFs. Here, we debunk the the most common myths about active ETFs.

-

Special Report

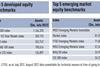

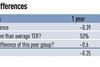

Special ReportGlobal emerging markets index investing: the case for an active component

Emerging market (EM) equities have an important role to play in broadly diversified institutional portfolios. Our data analysis shows that for investors who have a buy-and-hold strategy, an active component is needed to stay close to the benchmark because of trading costs and, more importantly, because of higher slippage costs by passive managers in downward markets.