ETFs – Page 8

-

Special Report

Special ReportFactor investing & smart beta: The smart beta (r)evolution

The ability of stocks with certain investment characteristics to outperform the market has been well understood and documented for decades. But options of how to implement this strategy were limited

-

Special Report

ESG: Building impact and values into portfolios

Exchange-traded funds that prioritise environmental, social and governance matters have grown exponentially in popularity over the past few years

-

Special Report

ESG: Responsible investing that reduces your carbon footprint

The development of ESG indices reflects growing interest in divesting out of fossil fuel investments to address the threat posed by global warming

-

Special Report

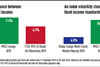

Special ReportFixed income: Consistent growth in a changing landscape

Fixed income, an asset class that historically traded over the counter, is increasingly being traded on exchange through exchange-traded funds (ETFs)

-

Special Report

Markets & regions: How commodities strategies can help investors diversify their portfolios

In the current market environment, investors are looking for asset classes that can lower overall portfolio volatility without sacrificing returns

-

Special Report

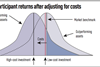

Special ReportImplementation: A cost comparison of futures and ETFs

The investment management industry has seen a relentless drive to wring out costs. A good grasp of implementation cost of using different vehicles for the same strategy matters

-

Special Report

Introduction: Competition and innovation

Consolidation has been a hallmark of the ETF sector in recent years as the market continues its growth trajectory, with global assets exceeding $5.7trn

-

Special Report

ESG: Managing indices to match convictions

More and more investors know it is perfectly possible to link index management with responsible investment by choosing an index fund or an ETF

-

Special Report

Special ReportNew frontiers: Getting to grips with cryptocurrencies

For institutional investors and asset managers, crypto-currencies pose a triple dilemma

-

Special Report

The market: ETF products and the current market

As the present elongated bull run is beginning to make some market participants nervous, investors should assess which ETF products could help them navigate changing market conditions

-

Special Report

Implementation: A liquid diet for trustees

The balancing act of locking assets up whilst retaining enough liquidity to meet member benefits, if done correctly, can improve the returns generated from a scheme’s asset allocation

-

Special Report

Special ReportMarkets & regions: The dynamic market in Japanese equity ETFs

Opinions of Japan as a market tend to be quite polarised and the country has looked cheap on a valuation basis for quite some time, both historically and relatively

-

Special Report

New frontiers: Esoteric ETFs – egregious or genius?

From companies capitalising on cannabis decriminalisation to the streaming of Quincy Jones’s music, you can almost guarantee there is an ETF available to enable you to invest in it

-

Special Report

Markets & regions: Spotlight on US equities

US equities have proven overwhelmingly popular with investors desperate for signs of economic growth

-

Special Report

Special ReportThe market: Understanding the ETF landscape and flows in Europe

April 2018 marked the 18th anniversary of the listing of the first ETF in Europe. Although no longer a new product, their growth rate continues to be impressive

-

Special Report

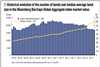

Special ReportFixed income: The growing world of fixed income ETFs

The fixed income ETFs market has experienced rapid growth in recent years as more investors are now finding a role for them in their portfolios

-

Special Report

Markets & regions: Using ETFs to position for a US–China trade war

Many media and market commentators believe that the potential US-China trade war could be one of the largest risks facing the global economy

-

Special Report

The market: Transatlantic invasion

The Americans are coming! But unlike the US cavalry providing an 11th-hour rescue in the last reel of an old-time Western, these Americans are moving in on what they hope will be a lucrative European ETF market

-

Special Report

Regulation: Spotlight on liquidity, transparency and viability

ETFs may represent a tiny speck on the overall investment landscape but they are one of the fastest-growing products in the investment industry

-

Special Report

The market: Tools in tune with the zeitgeist

2018 marks the year that exchange-traded funds (ETFs) dedicated to tracking environmental, social and governance (ESG) issues truly became mainstream