All Inflation articles – Page 2

-

Opinion Pieces

Opinion PiecesViewpoint: The new market reality requires a total portfolio approach

In this new era of lower returns with higher risk, investors must rethink how they balance risk, liquidity and returns with greater discernment and due diligence

-

News

NewsEIOPA: Pension risk stable, market risks still key concern

Geopolitical tensions are reshaping global dynamics, heightening concerns about declining international cooperation and escalating risks and uncertainties

-

Asset Class Reports

Asset Class ReportsEurope investment outlook: Search for opportunities amid the gloom

We asked fixed-income managers for their views on Europe’s outlook as Germany and France grapple with structural challenges and political uncertainty.

-

News

NewsInvestors weigh priorities in face of uncertain markets

Selective opportunities in private markets and medium-term risks in the US despite the current post-election bull market

-

Special Report

Special ReportProspects for 2025: Pension investors identify risk scenarios

High equity valuations and a possible return of inflation, caused by geopolitical tensions and US policy, have European pension funds worried

-

News

NewsSwiss social democrats, unions lay out vision to change second pillar pension system

Measures to close pension gaps, especially for women, are expected

-

Special Report

Special ReportIndia makes its debut in key government bond index

Their inclusion in the JP Morgan index makes government bonds more accessible to foreign investors

-

News

NewsSwedish municipal pensions debt surged amid inflation shock

Municipalities and regions in Sweden recorded a SEK42bn rise in their total pension debt last year, according to latest report from pension provider

-

News

NewsChanging macro environments lead to asset allocation shift for SWFs

SWFs are actively reassessing their asset allocation strategies, seeking to reduce their exposure to duration risk, says Invesco report

-

News

NewsEIOPA: European occupational pensions sector ‘remains resilient’

… but still sensitive to monetary policy developments

-

Analysis

AnalysisSwiss-based managers assess potential of emerging investment opportunities

Switzerland-based asset managers share insights on investments with a view to the latest trends in the pension industry

-

News

NewsIreland’s Pensions Authority launches trustee guidance on liquidity risk

The Authority’s guide highlights LDI, leveraged LDI, sale and repurchase agreements, swaps, currency hedging and inflation hedging as strategies to look out for

-

News

NewsUK DB schemes concerned over increasing volume of regulatory pressures

Russell Investments research shows that DB schemes’ concerns over regulation have more than doubled since autumn/winter 2022

-

News

NewsEmployers tackle volatility by offering more secure ‘cross border’ pension plans

The number of IPPs and ISPs plans in countries with challenging circumstances increased from 54 in 2019 to 126 in 2024

-

News

NewsSwedish, Finnish real pension returns hit hardest by inflation last year

Finnish Centre for Pensions uses average monthly inflation figures to compare real pension investor returns, revealing Sweden and Finland were worst hit in international comparison

-

News

NewsGerman finance ministry ups maximum interest rate

The rate, used to calculate the amount of reserve funds for pension payouts, is increasing to 1% from the current 0.25%, from 2025 – the first increase in 30 years

-

Special Report

Special ReportRound table: Manager selection priorities for 2024

IPE asked eight manager research business leaders: what will be the three most important topics or trends in manager selection over the next 12 months and beyond?

-

Opinion Pieces

Opinion PiecesViewpoint: A challenging period for emerging market debt or a golden opportunity?

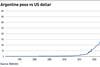

Despite the challenges posed by rising interest rates and the steep rise of the US dollar, none of the bigger emerging markets seem to be in debt distress

-

News

NewsGerman corporate pension funds see increased liabilities

Corporate pension obligations have already increased by around 17% at the end of 2023 compared with the previous year

-

Features

FeaturesWill delayed economic bad news hit the market this year?

Global economic growth was below potential in 2023, but still markedly stronger than the forecasts had been indicating at the start of the year, with the US leading the way and even the likes of Europe and the UK, though hardly stellar performers, posting better than expected economic activity.