All Inflation articles – Page 5

-

News

Pension funds demand engagement success from external managers

53% of pension funds are unlikely to hire an external manager that cannot demonstrate specific outcomes for engagement, according to bfinance

-

News

NewsIn-depth: Italy faces tax cuts pressure on pension investments, reforms

Adepp is in favour not only of reaffirming the autonomy of Casse di Previdenza, but also to improve efficiency of supervision and control mechanisms

-

News

Alecta slashes DB pensions cost, boosts payments – on inflation, rates surge

Sweden’s largest occupational pension provider lifts DB pension payments by nearly 11% and cuts premiums by 40%

-

News

PFZW to increase pensions by 6%

The Dutch healthcare scheme did not award the maximum allowed indexation in order to protect its buffer

-

News

KLP looks forward to high interest rates after 2.6% investment loss

Denmark’s LD says losses mitigated in October – also by inflation hedging, cutting equity risk

-

News

Varma overtakes Ilmarinen in size after Q3’s narrower loss

Finnish pension insurers all see declining solvency levels by the end of September, reports show

-

News

New Dutch pension contract fails to deliver indexation

Calculations shed doubt over an earlier claim by pensions minister Schouten that the new system would provide ‘a pension with great purchasing power’

-

News

NewsSwiss regulator expects underfunding for pension funds facing volatility

Some pension funds may decide to ultimately trigger restructuring measures

-

News

UK DB schemes may see ‘unexpected financial impacts’ due to high inflation

The impact of inflation on scheme funding will depend on the extent to which schemes have hedged their exposure to inflation

-

News

NewsAustrian schemes ponder pension cuts as inflation stirs up political debate

Austrian pension funds have recorded negative returns of 9.73% as of the end of September

-

News

UK roundup: Pension schemes boost stress testing as risk increases

Plus: FTSE 350 pension schemes’ surplus falls back to £5bn; Professional trustee market soars

-

News

NewsEuropean pension schemes grapple with indexation as inflation continues to rise

Inflation rate in Germany was up 10% in September

-

Opinion Pieces

Trustees must assess impact of rate hikes

The Bank of England (BoE) has hiked its policy rate by 50bps to 2.25%, prioritising the fight against inflation over support for growth in its domestic economy. This interest rate increase has hit levels not seen since the end of 2008 but in line with a majority of economists’ consensus.

-

Special Report

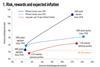

Special ReportInflation: expectations … and reality

In 2022, inflation surprised only on the upside, and surrounding economic conditions became increasingly uncertain. As short-term inflationary pressure has moderately spilled into inflation expectations – 10-year German inflation breakevens rose from 0.5% to more than 2% in 24 months1 – our DWS Long View capital market expectations for the next decade remain below historical averages.

-

News

NewsPPI urges DC schemes to consider greater inflation protection in portfolios

‘Any changes to investment strategy need to be approached pragmatically,’ PPI warns

-

News

Denmark’s IPD says pension savers will foot the bill for ‘rushed’ rents cap

Lobby group says real estate sector needs calm if pension firms are to invest, and broad political agreements

-

News

DB members could miss out on pension income amid inflation hike

DB pension scheme members could miss out on £25k worth of pension income due to inflation caps

-

News

European supervisory authorities warn of risks and vulnerabilities in EU financial system

Advising financial institutions and supervisors to continue to be prepared for a deterioration in asset quality

-

News

ECB prioritises tackling inflation with historic rate hike

Bank likely to raise interest rates by a further 50 and 25 basis points in the next two meetings before year-end

-

News

UK trustees disappointed with High Court’s RPI judicial judgement

This would reduce pension transfer values and lifetime incomes by 10% to 15% or more, says Insight Investment