Fixed Income – Page 11

-

Features

FeaturesNet zero’s bond index problem

The fixed-income space has not been short of sustainability innovations over the years.

-

Features

Insurance-linked securities wind brings good news for investors

In the two decades prior to 2022, the negative correlation between stock and treasury bond market returns has been a key driver of institutional investor portfolio construction. Fixed income allocations provided investors significant relief during equity market downturns and increased expected risk-adjusted returns for the popular 60/40 stock/bond portfolio.

-

Asset Class Reports

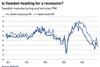

Asset Class ReportsDebt investors face European uncertainty

High interest rates and inflation are the biggest concerns as recession looms

-

News

NewsAustrian pension funds increase exposure to bonds

Pension funds returned 1.88% in the first nine months of 2023, and -1.34% in the third quarter of the year

-

News

NewsMismatch between Dutch funds’ SDG demands and investment opportunities

Bonds that finance projects that contribute to SDG 12 (Responsible Consumption and Production), Life below Water and Life on Land (SDGs 14 and 15) are especially hard to find

-

News

NewsSkandia stows $100m in Dutch-backed sustainability blended-finance fund

Swedish pensions firm praises ‘innovative’ structure of SDG Loan Fund for easing flow of institutional money to developing countries

-

News

NewsSwedish agency outlines next €17bn of premium pension tenders

FTN flags first index categories as next two procurements at end 2023 or early 2024

-

News

NewsKLP posts Q3 loss after NOK6bn property write-down

Norwegian pensions major says competitive situation stable, despite losing two municipal clients

-

Features

FeaturesIPE Quest Expectations Indicator - December 2023

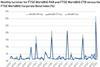

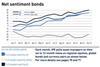

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Special Report

Special ReportProspects special report 2024: CIOs on what awaits investors

Asset management CIOs and strategists answer key questions about investment for the 12 months and beyond

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

Analysis

AnalysisReform of the AT1 bond market

UBS starts selling AT1 bonds for the first time since Credit Suisse takeover

-

News

NewsPublica tenders €2bn in corporate bonds mandates via IPE Quest

Tender is for two passive or enhanced passive corporate bond mandates – one for European and the other for US bonds

-

Country Report

Country ReportSwiss pensions: difficult 2022, partial recovery in 2023

The Complementa Risk Check-up is conducted annually and provides insights into the Swiss pension fund market. Andreas Rothacher and Ueli Sutter share some of the highlights of their findings

-

Country Report

Country ReportSpanish pensions report 2023: funds ride a wave of uncertainty

Diversification remains a key tool in pension fund portfolios

-

Features

FeaturesIPE Quest Expectations Indicator - November 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

News

NewsInarcassa’s new strategy sees cuts to equity in favour of bonds, infrastructure

Assets under management for first-pillar pension schemes, according to pension regulator Covip

-

News

NewsFondo Pegaso issues tenders for bonds, multi-asset mandates

The scheme plans to select three managers for an active bond aggregate strategy and one manager for two semi-active multi-asset type briefs

-

News

NewsATP tries to shift focus from investment losses to bonus capacity

Danish pensions giant says rising ability to increase pensions is a better measure of its financial health