Fixed Income – Page 16

-

Asset Class Reports

Asset Class ReportsPrivate debt: Managers take back control

Steady demand for private credit puts lenders in a strong position to negotiate beneficial terms, but discipline in lending remains crucial

-

Asset Class Reports

Asset Class ReportsPrivate debt: Sustainable lending set for comeback

Issuance of sustainability-linked paper took a hit in 2022, but managers are now introducing ESG KPIs to incentivise borrowers

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Private debt

The rise in interest rates and inflation throughout 2022 brought traditional fixed-income assets back into focus for investors. The threat of a recession, the pressure on investors to maintain liquidity in portfolios and the ‘denominator effect’, which sees investors over-allocated to unlisted assets after a torrid 2022 for listed equities and bonds, are all facts that would suggest that private debt markets will suffer. However, investors are still backing experienced private debt managers and allocations to the asset class are forecast to grow further in the medium term.

-

Country Report

Country ReportGermany: Financing the Energiewende

German professional pension funds like ÄVWL and BVK are keen to support the energy transition process

-

Features

FeaturesFrom soft landing to no landing

Once again, the US jobs market has shown its capacity to surprise forecasters, if not astonish them. January’s non-farm payroll numbers came in way above consensus forecasts, swiftly reversing markets’ dovish take on that week’s central bank actions, with bond markets handing back much of their earlier gains.

-

News

NewsSwedish buffer funds AP1, AP3 report 2022 losses of 8.6%, 5.8%

AP1’s CEO stresses importance of liquidity management; AP3 says emerging markets exposures to be analysed

-

News

NewsKLP portfolio loss just 1.1% in 2022 as long-term bonds, real estate pay

Norwegian municipal pensions provider benefits from 7.1% real estate return

-

Features

FeaturesAhead of the curve: Time to automate collateral management

The resilience of financial markets has been tested several times in recent years, from the so-called ‘dash for cash’ at the start of the coronavirus pandemic in March 2020 to the spike in UK Gilt yields in September 2022.

-

Features

FeaturesIs the US heading for a soft landing?

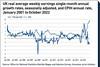

Rare though they are in history, a soft landing for the US economy seems to be the consensus forecast, a view aided by news of a sharp contraction in the Institute of Supply Management (ISM) Services Purchasing Managers index in December. The jobs market also looks like it is slowing down and there are signs of a cooling off in wages, with lower-than-expected average hourly earnings reported in December’s non-farm payroll report.

-

News

NewsNorway SWF loses 14% on assets in 2022 but stages a rebound in January

For first time, NBIM outperforms in a loss-making year

-

News

NewsIndustriens 17.9% infrastructure return mitigates negative 2022 result

Danish pension fund says renewable energy infrastructure assets rose in value during the year

-

News

Nordic pension funds tilt equity portfolios to value amid high inflation

Persistent high inflation could cause headaches for some providers, due to inflation-linked benefits - but hopes are high for slower price rises

-

News

NewsERAFP’s €300m equity mandate to be benchmarked to Scientific Beta’s climate index

Plus: Institutional investor seeks manager for €70m corporate bonds brief

-

News

NewsInarcassa ups bonds, cuts equities in new strategy

The scheme has also decided to integrate a sustainability element in its latest asset allocation strategy

-

Asset Class Reports

Asset Class ReportsAsset class report – Fixed income

Last year was the worst in recent decades for both government bonds and credit, with portfolio returns worse than most professionals have experienced in their careers. But is the tide finally shifting as inflation starts to moderate and terminal policy rates are in sight? In any case, geopolitical risks and inflation are not set to go away, and recession will inevitably take a toll on corporate issuers.

-

Asset Class Reports

Asset Class ReportsFixed income: Transition plans and green bonds

Should companies publish climate plans before they can issue green bonds?

-

Features

FeaturesFixed income, rates & currency: Inflation strengthens its grip

Whereas news of the hostilities in Ukraine may be losing their potential to shock and dislocate the world economic order, inflation news has maintained its powerful hold over financial markets across the world throughout 2022, with many economies recording their highest inflation levels for decades.

-

Asset Class Reports

Asset Class ReportsFixed income: Paradigm shift for investors

Credit is looking more attractive on a risk/reward basis for new investment, but the factors that led to the 2022 volatility have not disappeared

-

News

NewsIlmarinen adds foreign property and corporate bonds to climate goal

Finland’s number two pensions insurer adds new asset types to climate road map published last year

-

Special Report

Special ReportProspects 2023: Does zero China make sense?

Many investors are avoiding the People’s Republic, but they would do well to look at the reality