Fixed Income – Page 20

-

Features

FeaturesFixed income, rates & currency: Markets grapple with inflation and slowdown

The global outlook for economic growth is deteriorating, with repeatedly revised economic forecasts pointing to ever-higher inflation and lower GDP growth. The far-reaching impacts of the Russia-Ukraine war, moving principally through energy and commodity channels, have exacerbated so many of the world’s existing pandemic-related supply-side bottlenecks, which had been gradually easing in the weeks and months before Russia invaded.

-

News

Generali Investments buys EIB digital bond tokens on Ethereum blockchain

Early move by Italian asset manager in digital bond secondary market as blockchain edges towards the mainstream

-

Asset Class Reports

Asset Class ReportsCredit: Anthropocene fixed income

Former credit portfolio manager Ulf Erlandsson is on a mission to shake up the bond markets’ climate-change credentials

-

Asset Class Reports

Credit: EU raises the green bond stakes

The EU is considering making its Green Bond Standard mandatory

-

Asset Class Reports

Asset Class ReportsCredit: Investors cautious over Ukraine war

Despite geopolitical tensions, inflation and rising costs, private debt market remains optimistic after a record 2021

-

Features

FeaturesFixed income, rates & currencies: War and inflation dominate

While we watch horrible scenes of towns and cities under bombardment, their bewildered and bloodied citizens desperately searching for safety, the huge shockwaves generated by the Russian invasion of Ukraine are spreading rapidly far beyond both countries’ borders.

-

News

NewsInvestment pool duo launches new funds claiming £4.6bn in LGPS assets

Border to Coast launches £1.4bn listed alternatives fund, while ACCESS adds £3.2bn to the LGPS pool

-

Features

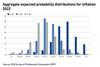

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

Features

FeaturesBriefing: High yield off to a rough start to the year

High yield did not have a good start to the year. Rising inflation and a more hawkish central bank tone in the US and UK triggered panic selling in January. However, as the dust settles and bad news is priced in, the asset class looks more appealing than other fixed-income segments. Easy pickings may be gone, though, and opportunities will have to be selected carefully.

-

News

NewsSwedish buffer funds: AP3 posts 21% while PE-only AP6 returns 49%

Listed equities, alternatives and krona weakness power returns in 2021, says AP3

-

News

Alecta sees current volatility creating good credit opportunities

Swedish pension fund reports 24% return for 2021; thanks rising stock markets, strong property market and own work to find fixed income returns

-

News

KLP, Nordic banks, launch transition financing code for shipping

‘Guidelines for Transition-linked Financing’ for the shipping industry aimed at increasing transparency around firms seeking rate discounts on loan/bond financing

-

News

NewsSustainable bond issuance growth to slow on way to $1.35trn total in 2022 – Moody’s

Prediction that sustainability-linked bond issuance to more than double, however

-

Features

FeaturesFixed income, rates, currencies: COVID starts to lose grip on GDP

COVID’s huge influence on all our lives, whether through disruption of global supply chains or threats of lockdowns in the face of soaring infection rates, was reasonably constant throughout 2021. However, it now appears that GDP numbers have become generally less sensitive to COVID infection rates than they were, say, 18 months ago, with high vaccination rates (certainly across developed markets), and an awareness from politicians that the public’s willingness to comply with lockdowns may be waning fast.

-

News

Tech stocks and property drive Norway SWF’s second best NOK returns

‘Clearly we don’t expect this development to continue like this,’ says Tangen

-

News

Alecta says $75m blue bond investment meets sustainability, risk/return needs

Bond will enable Belize to refinance existing debt at lower cost, releasing $180m earmarked for marine preservation, says Swedish pension fund

-

News

NewsIcelandic pension funds tackle low rates by cranking up equities allocation in 2022

New investment policies for Birta, Frjálsi and Almenni include raising equity weighting in some portfolios

-

News

Master trust launches green impact strategy with Wellington, Lombard Odier

Wellington will manage impact bonds with both a climate and social focus, whilst Lombard Odier will manage bonds focussed on positive climate impact

-

News

Alecta invests $250m in natural catastrophe risk via Swiss Re platform

Sweden’s largest pension fund says asset is highly diversifying and still produces attractive return over time

-

Asset Class Reports

Asset Class ReportsABS stages a comeback

‘Punitive’ regulations and onerous policies in the wake of the financial crisis saw the ABS market shrink dramatically. But complexity and an illiquidity premium offer opportunities for pension funds