Fixed Income – Page 14

-

Asset Class Reports

Asset Class ReportsFixed income & credit – Sustainability-linked bonds

Sovereigns and other issuers are yet to embrace sustainability-linked bonds but issuance is growing

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Fixed income & credit

Factors including rising inflation and interest rates, the war in Ukraine, and the uncertainty surrounding the global economy might have significantly slowed down the growth of an alternative asset class like private debt. But this has not been the case, and while fundraising by private debt managers for 2022 and 2023 might be challenging, investors are making new long-term commitments.

-

Interviews

InterviewsOn the record: Doubling down on debt

Pension funds are focusing on both listed fixed income and private credit

-

Analysis

AnalysisAnalysis: German states realign €30bn pension fund assets to stricter ESG standards

Four German states have recently revised their sustainable investment strategies, sticking to stricter ESG rules

-

News

NewsSwiss pension funds set to change SAA to reach bond investment targets

According to Swisscanto, 17% of pension funds surveyed adjusted their strategic asset allocation, and 35% changed allocations tactically.

-

News

NewsMandate roundup: Swiss pension fund tenders investment grade mandate

Plus: Swedish Fund Selection Agency hands mandate to Style Analytics

-

News

NewsGerman BVV allocates €1.5bn to high rating investment grade bonds

The fund will pursue an active risk management approach, especially in volatile asset classes

-

Features

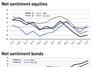

FeaturesIPE Quest Expectations Indicator: June 2023

Continued loud bickering between the Wagner Group and the Russian army is protecting Putin from both, worsening the outlook for peace, while there are multiple signs that military supplies are approaching exhaustion. The coalition supporting Ukraine is stronger than ever, showing increasing willingness to provide military aircraft. Yet the offensive expected in February has not started. In the US, Florida governor Ron DeSantis is damaging his position with an unproductive row with Disney, while Trump has moved closer to a prison term. Gas consumption in the EU is falling faster than expected, due to efficiencies like heat pumps, changeover to electricity and solar panels. Macron scored nicely by sponsoring the participation of Zelensky at the Hiroshima G7; Sunak failed to centre political attention on China.

-

Special Report

Special ReportOutlook – Europe and the world: CIOs focus on bonds and quality stocks

With the prospect of weaker growth, volatility and higher inflation and rates, strategists argue for more selectivity in investments

-

Features

FeaturesFixed income, rates & currency: Strong labour markets surprise

Global purchasing managers’ index (PMI) data, which measures the state of the US economy, has been mostly strong, although manufacturing indices have been considerably weaker than services, perhaps reflecting their greater sensitivity to higher interest rates.

-

News

NewsItaly roundup: Previndai ups exposure to corporate, government bonds

Plus: Eurofer pushes on with direct investments

-

News

NewsIceland’s pension funds fear €1bn losses under housing bond plan

Pension fund group says on firm legal ground, and warns the government of years in court

-

News

NewsSurvey shows 65% of European institutional investors eye social bonds

Investors are, however, not prepared to pay a ‘social premium’ on social bonds

-

News

NewsGermany’s BVK looks to expand investment grade bonds portfolio

Investment grade bonds have become ‘significantly more attractive’ because of increasing interest rates

-

News

NewsIcelandic pension funds decry government reneging on housing bond terms

Pension funds are collectively largest owner of HFF bonds, which Icelandic government plans to terminate

-

News

NewsComPlan to look at UN SDGs in private equity, debt investments

The scheme included physical and transitional climate risks in an ALM analysis for the first time last year

-

News

NewsItaly roundup: BCC-CRA pension fund divests from private markets

Plus: Fondo Priamo increases number of members and contributions; Enpaia cuts real estate investments

-

News

NewsFINMA faces further legal action for AT1 bonds write down

Migros Pensionskasse expects court to recalibrate supervisory authority’s decision

-

News

NewsItaly roundup: Enpam plans to build up global bond portfolio

Plus: Write downs hit Enasarco; Laborfonds sees sign of return to normality

-

Features

FeaturesIPE Quest Expectations Indicator May 2023

Russian air superiority over Ukraine is coming to an end due to lack of equipment. Destroying civilian targets is counterproductive and consumes ammunition. Bakhmut is eating into Russian resources, while Ukraine is being re-armed. History teaches that better technology, rather than numerical superiority, wins wars. But even a lopsided Ukrainian win would not automatically mean peace.