Norway’s dominant municipal pension provider, KLP, this morning reported a slim loss on its investments for the third quarter, bucking its positive quarterly trend achieved so far this year.

The NOK972.3bn (€82.5bn) pensions institution, which is owned by most of Norway’s local authorities, revealed it had to make a NOK6bn write-down on its large real estate portfolio in the period.

KLP, which now has a 10.8% weighting to property in its NOK718.2bn common portfolio – which holds the bulk of its assets – said in its financial report for July to September that the write-downs had been based on higher required rates of return due to higher interest rates.

“There is still uncertainty associated with the effects of the various factors that influence the property market, including interest rates, required rate of return, inflation and costs,” KLP said.

Overall, the pensions giant reported a -0.3% return for the common portfolio in Q3 in value-adjusted terms, bringing the year-to-date return to 3.9%. It described the result as a “competitive return in a quarter marked by weak performance in the financial and property markets.”

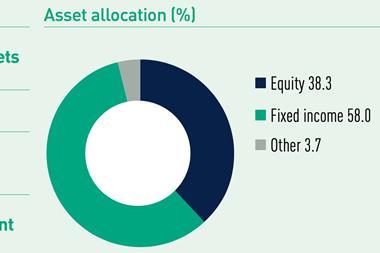

Equities and alternatives, which comprised 30.9% of the portfolio, resulted in a -1.0% loss in the quarter, with global equities having suffered a -3.0% loss against a 6.1% gain for Norwegian shares, according to the report.

Meanwhile, bonds recognised at amortised cost – 29.1% of the portfolio at the end of the quarter – were booked as having returned 1.0% in the three-month period.

However, KLP said unrecognised decreases in value in the portfolio had amounted to NOK16.9bn at the end of the third quarter.

KLP also mentioned the competitive situation in the Norwegian municipal pensions market in its report, saying two local government customers had decided to move to another provider.

“On the corporate side, there are a small number of companies that are considering which pension solution to take in the future and which provider they might want to use,” KLP said.

Rival Storebrand, which is trying to win clients from the near-monopolistic KLP, recently said it had regained the custom of Askøy, and forecast increasing competitive activity in the sector from then on into next year.

Read the digital edition of IPE’s latest magazine