Emerging Market Debt – Page 3

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Emerging markets

It is no secret that while investments in emerging markets promise to deliver superior returns, thanks to their exposure to faster-growing economies, actual performance has been volatile and, at times, disappointing. Over the past decade, emerging market indices have outperformed, as have fund strategies.

-

News

APG invests $750m in new SDG-focused EM private credit fund

The money will be invested in loans originated and structured by international development banks, with a focus on financing sustainable projects

-

Asset Class Reports

Asset Class ReportsUS banks lead a boom in debt issuance

Capital requirements and locking in cheap funding have prompted banks to issue more bonds, but Europe lags behind

-

Asset Class Reports

Asset Class ReportsAsset Allocation: Mixed prospects emerging

COVID and political risks may have affected EMs in different ways but there are still many opportunities in such a diverse asset class

-

Asset Class Reports

Asset Class ReportsEmerging Market Debt: Populism battles ESG in Latin America

Many policies championed by populist leaders in Latin America are in direct conflict with the ESG goals of global investors

-

Special Report

Special ReportCommentary: A mile in Xi’s shoes

The shift from ‘trade war’ to ‘tech war’ between China and the US has forced China’s policy makers to deal with the country’s three key vulnerabilities

-

Asset Class Reports

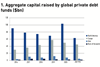

Asset Class ReportsThe next frontier for private credit

Global managers are making a strong case for investment in private credit issued by emerging market companies

-

Asset Class Reports

Asset Class ReportsEmerging market debt report

Our opening article in this report looks at emerging market private credit. In EMs there is a $100bn corporate funding gap with 90% of lending through banks. But we find EMD managers broadly cautious overall, particularly on China, with interviews conducted before the Evergrande story broke. Lastly, we look at Latin America, where investors encounter populism and social unrest but sustainability bond issuance is booming.

-

News

Migros Pensionskasse adds EM bonds to strategic asset allocation

Migros’ asset management goals include a reduction of CO2 intensity of its equity and corporate bonds portfolios by 2% per year

-

News

NewsDutch insurer seeks managers for small-cap equity

Plus: Discovery search for global EM fixed income

-

News

Danske saw ‘high investor interest’ for Alecta-bought social bond

Could take time for institutions to find right place in mandate for this type of impact investment, says Hökfelt

-

News

Alecta invests $100m in part state agency-guaranteed EM social bond

Swedish pension fund giant achieves the scale it desires through placement

-

News

NewsLGIM, Universal Investment kick off DACH partnership with EMD fund

Further fund launches could come

-

Opinion Pieces

Opinion PiecesCapital will drive best practice in reporting

The European Commission’s review of the Non-Financial Reporting Directive (NFRD), scheduled for publication shortly, comes at a time of increased scrutiny of both corporates and those who supply them with debt and equity.

-

Features

Rising interest in EM debt

The weak dollar and low US interest rates are pushing governments and companies in emerging markets (EMs) to issue growing volumes of dollar-denominated debt.

-

Opinion Pieces

Opinion PiecesCOVID-19 barely tested the financial system

The financial system seems to have coped well with COVID-19. This is despite the repeated recent warnings about a build-up of systemic risk. In turn this has been linked to the abundance of cheap debt and the growth of the asset management industry.

-

News

UK roundup: LGPS Central emerging market bond fund launched

Plus: LAPFF seeks assurances over Arizona copper mine project

-

Special Report

2021 Investment horizons: Sovereign debt in the wake of the pandemic

Current issuance levels look like an experiment in government debt. What are the warning signals for investors?

-

News

NewsSweden’s Kåpan ups green bond weighting, expands fossils strategy

Swedish government employees’ pension fund says it bolstered sustainability in asset classes as well as overall operations this year

-

Asset Class Reports

Asset Class ReportsEmerging Market Debt: Covid delivers a booster shot

The pandemic has reinforced the view that ESG-compliant businesses are better able to cope with market shocks