Emerging Market Debt – Page 2

-

News

NewsSwiss occupational scheme tenders up to CHF1.2bn in bond mandates

The searches are for emerging market debt and US high yield bonds, considering both active and passive options

-

News

NewsRobeco poaches EMD team from Candriam

The addition of a sovereign emerging market debt strategy ‘is an important step in addressing market demands’, according to the Dutch asset manager

-

News

NewsAlecta, APK back $436m Amundi-IFC impact-oriented EM bond fund

Public-private partnership aims to encourage issuance of green, social and sustainability-linked bonds in emerging markets

-

Opinion Pieces

Opinion PiecesViewpoint: A challenging period for emerging market debt or a golden opportunity?

Despite the challenges posed by rising interest rates and the steep rise of the US dollar, none of the bigger emerging markets seem to be in debt distress

-

Asset Class Reports

Asset Class ReportsLocal currency emerging market bonds are back in the spotlight

Partly thanks to the weakening of the US dollar, local currency emerging market sovereigns are now offering healthy yields, and should continue to perform well

-

Asset Class Reports

Asset Class ReportsEmerging market debt: Corporates struggle to sway bond investors

There are mixed views about the prospects for emerging corporate debt, despite the sound fundamentals

-

Asset Class Reports

Asset Class ReportsRoom for more GSS bonds in emerging markets

The market has already broken new ground, but there’s hope for more innovation, say experts

-

Asset Class Reports

Asset Class ReportsCorporate borrowers in emerging markets put to the test

Many emerging market companies have healthy balance sheets and weathered the COVID crisis well. How will they fare if global growth slows?

-

Features

FeaturesThe US dollar’s declining status as a global reserve currency

The recent US debt ceiling negotiations have brought into question the viability of the US dollar’s status as a global reserve currency. Long-term investors have been reviewing their strategic asset allocation away from the currency, seeking to diversify their exposure and to take advantage of long-term investment opportunities.

-

News

NewsSovereign investors reshape portfolios after year of negative returns

Sovereign investors are now more resolute than ever in their ambitions to fund the energy transition

-

News

NewsILX Fund invests first $400m in Dutch pension money in EM private credit

The Amsterdam-based impact fund, which invests in syndicated loans originated by development banks, is plannning to start fundraising for a second $2bn fund

-

Opinion Pieces

Opinion PiecesEmerging market investors should take the long view

For institutional investors, investing in emerging markets is a true test of fiduciary duty. The asset class – if it can be defined as such – has enormous potential, yet it is also risky, not just in terms of volatility but also of reputation.

-

News

NewsPassive and sustainable investing in EMD: hard to combine for small funds

EMD had long been considered the last frontier for passive investors, as the asset class was seen as insufficiently liquid and therefore hard to replicate

-

News

Varma diversifies EM bonds away from govvies with $50m in corporates

Finnish pensions heavyweight makes first foray into EM corporate bonds, buying into HSBC AM’s bottom up fixed-income fund

-

Asset Class Reports

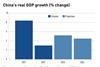

Asset Class ReportsEmerging market debt: China government bonds

The outlook for Chinese government debt is looking less attractive

-

Asset Class Reports

Asset Class ReportsEmerging market debt: managers face choppy waters

Some see opportunities as investors have exited the asset class but emerging economies continue to face divergent trajectories

-

Asset Class Reports

Asset Class ReportsEmerging market debt report

This year has seen hefty losses on the main emerging market debt indices, in both hard and local currency denominated bonds. Investors are left assessing whether these price moves are justified. Or has the market overreacted to US rate rises and the war in Ukraine, leaving markets as a whole underpriced?

-

Interviews

InterviewsOn the record: Emerging market debt

At a time of high volatility in interest rates, currencies and GDP, two seasoned investors in emerging market debt discuss their approaches

-

Features

FeaturesChina calls the tune for emerging markets

If President Xi Jinping mismanages China, the careers of many emerging market asset managers could be over. It would also mean emerging markets as an asset class would become irrelevant, at least according to Xavier Hovasse, head of emerging markets at the French fund management house Carmignac, who has devoted his career to seeking opportunities in emerging markets.

-

News

PMT, PME ditch ‘authoritarian countries’ from EM index

The two Dutch pension funds have sold Egypt and Vietnam government bonds as a result of the policy change