All IPE articles in June 2019 (Magazine) – Page 3

-

Asset Class Reports

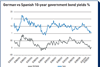

Asset Class ReportsGovernment Bonds - Euro-zone: Turning Japanese

The euro-zone appears to be in a low-growth liquidity trap redolent of Japan

-

Book Review

Book ReviewBook review: The Rise of the Working-Class Shareholder

David Webber is well placed to rehearse the legal and political arguments around public pension funds’ power to change companies

-

Special Report

Special ReportMulti Boutiques

Can multi-affiliate boutique structures combine the benefits of consolidation with the cultural advantages of smaller, focused managers?

-

Features

Briefing: Guidance for valuation of ILS

Valuation has always been an important, albeit thorny, component in assessing insurance-linked securities (ILS) but the higher-than-expected losses in 2017 and 2018 made the number crunching even trickier. The recently published set of guidelines from the Standard Board of Alternative Investments (SBAI) is designed to improve the process but investors should always be aware of the risks attached to this asset class.

-

Country Report

Iceland: Full overhaul on the cards

Iceland’s government is preparing for a comprehensive review of pension fund issues

-

Country Report

Denmark: Schemes challenge regulator on guarantee

Regulatory developments and the low-interest-rate environment are pushing pension funds to move away from guaranteed schemes

-

Features

FeaturesDC’s collective voice could be decisive

Australian pension funds could soon become the biggest shareholders in their country’s equity market (see page 5), with researchers at Rainmaker Information forecasting their combined domestic stock holdings to hit 60% by 2033.

-

Country Report

Norway: Paving the way for competition

Municipal reform and proposed new public-sector scheme is creating a fertile environment for competition

-

Country Report

Sweden: Reform focus turns to quality and cost

Phase two of Sweden’s premium pension system reform aims to weed out poor investment pension funds and preserve the best

-

Interviews

InterviewsHow we run our money: CPEG

Grégoire Haenni, CIO of CPEG, the public pension fund for the Swiss canton of Geneva, explains the fund’s multidimensional approach to asset allocation

-

Opinion Pieces

Opinion PiecesLetter from the US: Practitioners defend ESG from executive threat

The proxy season was different in the US this time around. Environmental, social and governance (ESG) resolutions – as well as the use of those criteria for investing – are under scrutiny by the Trump administration and the Securities and Exchange Commission (SEC).

-

Special Report

Technology: Disparities impede EU progress

The EU is not achieving its true potential on the global technology stage because it is still not operating as a fully fledged single market

-

Special Report

Special ReportSuccessful investment firms don’t dodge industry realities

Culture is a big differentiator in determining the successful asset managers of the future

-

Special Report

Special ReportThe origin of ESG indices

What does the proliferation of sustainable benchmarks mean for passive ESG investing?

-

Special Report

Special ReportESG: Weight of evidence

There is no consensus on a positive link between ESG and improved portfolio performance

-

Features

ESG: Evolving non-financial reporting

This month, the European Commission is due to release guidelines on climate-related reporting by companies.

-

-

Features

FeaturesInterview: Haukur Hafsteinsson, LSR

The government pensions veteran bids farewell to LSR, Iceland’s largest pension, after 34 years as its chief executive

-

Interviews

InterviewsOn the Record: Tough times at home

We asked two pension funds to share their views about investing in Europe at this crucial juncture for its economy

-

Opinion Pieces

Opinion PiecesIPE Perspective: Two sides to the MMT premise

Is there any merit in functional finance versus classical economic theory?

- Previous Page

- Page1

- Page2

- Page3

- Page4

- Next Page