Asia-Pacific: Pensions and Investment News and Analysis

Latest news and analysis of pensions, asset management, regulation and trends in the Asia-Pacific region from our award-winning journalists.

-

Analysis

AnalysisMacro focus: debasement and fiscal dominance

The price of gold and other precious metals will continue to soar next year, as investors shift focus away from currencies

-

Features

FeaturesIPE Quest Expectations Indicator - July 2025

US President Donald Trump remains the main source of global political risk. In recent weeks, he has ramped up pressure on Russia over the ongoing war in Ukraine while the success of his interventions in Israel’s dual conflicts with Hamas and Iran is uncertain.

-

Features

FeaturesChart watch: Uncertainty following tariff announcements persists

Though much of the damage caused by the so-called 2 April ‘Liberation Day’ announcement of US tariffs has been repaired, uncertainties generally remain high.

-

Features

FeaturesChart watch: Uncertainty ripples across markets

The trade war unleashed by Trump’s tariffs and the knock-on effects for business confidence and commodities demand are reflected in our latest chart overview

-

Features

FeaturesReforms boost appeal of Japanese equities despite trade challenges

It has been a long time coming but Japan’s corporate governance reforms are finally winding their way through the system, giving investors new-found confidence in its equity markets.

-

News

NewsNorway’s SWF rekindles Trump-backed end to quarterly reporting

NBIM says mandatory quarterly reporting by businesses can lead to short-term decision-making, hindering sustainable growth and innovation

-

News

NewsVarma invests €500m in made-to-measure Japanese low-emission ETF

Finnish pension firm’s listed chief says Varma will carry on creating more sustainability products

-

Special Report

Special ReportIndia makes its debut in key government bond index

Their inclusion in the JP Morgan index makes government bonds more accessible to foreign investors

-

Special Report

Special ReportPrivate equity in India: growth of a new investment class

Private equity had a faltering start in India, but the market is maturing and offering plenty of opportunity

-

Special Report

Special ReportTime to understand India

The country has much to offer investors, with impressive GDP growth, an innovative tech industry and soaring consumer demand

-

News

NewsAP7 divests €100m of largely Chinese oil and coal stocks

Swedish premium pension default provider says coal phase-out is ‘single most important measure to curb climate change’

-

Asset Class Reports

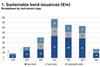

Asset Class ReportsThe quest for innovation in sustainable fixed income

Japan’s climate transition bond is the latest in a string of innovative developments in sustainable fixed income

-

News

NewsFirst quarter sees uptick in sustainability bonds

Market represents a lower proportion of wider bond markets, despite recent growth in issuance

-

Features

FeaturesAn inflection point for India bonds

The impending inclusion of Indian government bonds (IGBs) in JP Morgan’s widely tracked $240bn (€220bn) Govern ment Bond Index-Emerging Markets (GBI-EM) index is seen as a milestone. However, while some asset managers hope it is the beginning of a more open investment culture, others are more circumspect.

-

Asset Class Reports

Asset Class ReportsEmerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?

-

Asset Class Reports

Asset Class ReportsJapanese stock market finally lives up to expectations

Stocks rally, helped by rising inflation and corporate governance reforms

-

News

NewsGRI launches Sustainability Innovation Lab with IFRS Foundation support

New hub aims to support reporting using GRI standards and ISSB standards

-

Opinion Pieces

Opinion PiecesAustralian super funds expand their global footprint

With billions of dollars flowing into its treasury each year, Australia’s largest industry super fund, AustralianSuper, is finding that it is rapidly outgrowing its own backyard.

-

Opinion Pieces

Opinion PiecesConcerns over plans for Australian super funds to provide advice

In what some see as a controversial move, Australia’s Labor government under prime minister Anthony Albanese has reformed the nation’s financial advice industry, opening the door for industry superannuation funds to offer financial advice to millions of members.

-

Special Report

Special ReportInvestors take a cautious asset allocation path on Asia

Investing in the region is far from straightforward, with benchmarking particularly tricky