Asia-Pacific: Pensions and Investment News and Analysis – Page 6

-

Opinion Pieces

Opinion PiecesLetter from Australia: A question of gender imbalance

Statistics offer a snapshot into the real world and they reveal a depressing picture of gender inequality in Australia’s superannuation system.

-

Opinion Pieces

Opinion PiecesEmerging markets require a rethink

A rethink of the term ‘emerging markets’ is long overdue. It has always been a catch-all category but the gap between the description and reality is becoming over-stretched.

-

Opinion Pieces

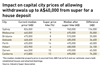

Opinion PiecesLetter from Australia: Should super savings fund homes?

A post-COVID-19 housing boom has made the future of Australia’s A$3trn (€2trn) superannuation savings pool a hot topic.

-

Opinion Pieces

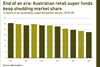

Opinion PiecesLetter from Australia: Retail super funds in distress

Australia’s once-dominant retail super funds are witnessing the end of an era as they wrestle with loss of consumer confidence in their brands. Hastening change has been the rise of industry supers, which benefitted from damaging evidence provided to the Hayne Royal Commission in 2018.

-

Features

FeaturesChina: Caught in the crossfire

The investment world is at risk of being caught in the midst of a ‘geoeconomic’ conflict between the world’s main economic blocs

-

Opinion Pieces

Opinion PiecesCulture wars pose the greatest dangers

What areas within the increasingly bitter conflict between China and the West are most likely to hit asset owners?

-

Opinion Pieces

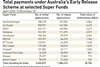

Opinion PiecesLetter from Australia: Early access genie escapes the bottle

In March 2020, as the Australian economy went into COVID-19 lockdown the government unlocked the national superannuation pool, seeking to ease the financial stress on individuals.

-

Opinion Pieces

Opinion PiecesThe world is approaching an inflection point

Domestic challenges and US political developments have proved such a preoccupation recently that it has been all too easy to miss a key global shift. China’s rise to global prominence has accelerated markedly as a result of the past year’s events.

-

News

NewsNBIM urges smoother functionality in HK IPO settlement plan

Norway’s giant SWF gives views on Hong Kong Exchanges IPO modernisation

-

News

PBU cornerstone investor in new southeast Asia women’s fund

Danish pension fund CEO says women ‘foundation of the family’ in developing countries

-

Special Report

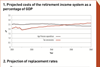

Special ReportDefined contribution: Australia's super review re-opens old battlegrounds

The Callaghan report on Australia’s universal superannuation system has rekindled a row between the government and the labour movement

-

Features

FeaturesBriefing: Japan emerging from its invisible lockdown

Japan is all too often portrayed as being different from other countries. Not just distinctive in the obvious sense that every country has its own national peculiarities. Instead, somehow unique in a way that makes it stand out from every other country.

-

Opinion Pieces

Opinion PiecesJapan is not that different

One of the abiding myths about Japan is that it is different from everywhere else. Not just distinctive in the sense that all countries have peculiarities but uniquely different.

-

News

NewsESG roundup: NN IP sees €300bn green bond issuance next year

Plus: GPIF allocates to gender-diversity index; Denmark’s Sampension adds 79 stocks to blacklist

-

News

NewsOsmosis gains Commonwealth Super in Australian debut

Earlier this year Osmosis appointed industry veteran Mike O’Brien as special advisor to its asset management business

-

News

Japan’s GPIF seeks input on low yield environment entrenchment

¥167.5trn (€1.4trn) pension investor also looking for ideas about estimating returns for bonds in post-pandemic era

-

Opinion Pieces

Opinion PiecesLetter from Australia: Reforms not super for default funds

A string of government reforms due to come into effect from July 2021 has caught the superannuation sector off-guard.

-

News

GPIF: Climate risk impacts all asset classes

If the world could limit global warming from greenhouse gas emissions to 2°C, the value, particularly of Japanese companies, would increase

-

News

NewsAustralian pension fund settles climate change-related lawsuit

UK-based lawyers say pension funds there should also take note

-

Opinion Pieces

Opinion PiecesLetter from Australia: Funding the future world

A handful of Australian superannuation funds are committing their members’ savings to the future world in terms of energy, water, technology and ideas. There will be successes and failures as ideas are developed and marketed.