Asia-Pacific: Pensions and Investment News and Analysis – Page 2

-

Special Report

Special ReportHow investors are positioned to capitalise in APAC private markets

Strong fundamentals and a lack of correlation with western markets make the region particularly attractive

-

Special Report

Special ReportAsia Investment - Special Report

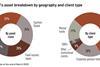

In this month’s special report on Asia, IPE’s private markets editor Lauren Mills analyses why global institutional investors are setting their sights on Asia. The combination of strong fundamentals and a lack of correlation with the European and North American economies make the region’s private assets particularly attractive. Investors are particularly hungry for infrastructure assets as well as the region’s fast-growing digital infrastructure.

-

Special Report

Special ReportSumitomo Mitsui Trust's Yoshio Hishida on Japan's unique position to attract investment

Yoshio Hishida, CEO of Sumitomo Mitsui Trust Asset Management, one of Japan’s largest investment managers, talks to Christopher Walker about his company’s focus on retail and attracting international capital

-

News

NewsNorway’s SWF criticises Japan’s new M&A guidelines

NBIM says “unclear” rules around corporate valuations could let boards reject takeover bids without challenge

-

Opinion Pieces

Opinion PiecesLetter from Australia: Retail funds lured by private markets

Australia’s retail funds are trying to navigate the unfamiliar terrain of private markets as they seek to lift their performance.

-

Opinion Pieces

Opinion PiecesAustralia: volatility stirs valuations debate

As a disconnect in the valuation of listed and unlisted assets widens in today’s volatile markets, the torchlight is again being trained on Australia’s guardians of retirement savings.

-

Opinion Pieces

Opinion PiecesAustralia: Caps, concessions and class war

The Australian Federal government recently moved to make a “modest” change to the nation’s superannuation system which, it says, will save A$2bn (€1.2bn) a year for its over-stretched budget.

-

Features

FeaturesJapan: New hand on the tiller

Kazuo Ueda, is the first new governor of the Bank of Japan (BoJ) in 10 years. One of outgoing governor Haruhiko Kuroda’s last moves was to widen the yield curve control (YCC) band on 10-year bonds from +/-25bps to +/-50bps. The reaction from the bond market over the following few days was to trade to the new upper limit.

-

Interviews

InterviewsNikko Asset Management: Complex, creative thinking

Stefanie Drews is at home with complexity. She speaks several languages fluently, including Japanese, and tells us she still does her maths in Italian.

-

Opinion Pieces

Opinion PiecesAustralia: Super funds shift to fixed income

With fear of recession in Australia and globally, superannuation funds have gone into defensive mode. Cash and liquidity are two key considerations for CIOs, and some are waiting to take advantage of attractive market opportunities.

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Investors watch as China corrects course

The Chinese government has managed to restart the economy post-COVID, but investors are cautious

-

Features

FeaturesThe West should understand the strengths and limitations of Enterprise China

China is fast becoming the West’s bogeyman. Yet a hard decoupling of the two would be a lose-lose situation for both. Despite the tensions, private companies face the challenge of creating viable strategies for interactions with China that could make the difference between success and bankruptcy.

-

Asset Class Reports

Asset Class ReportsEmerging market equities – India’s dancing elephant in the room

Despite challenges with corporate governance and corruption, the prospects for India are too bright to ignore for investors

-

Features

FeaturesResearch: How pension funds look at Chinese assets

Allocations to Chinese assets are still modest. Vincent Mortier and Amin Rajan discuss key issues in the third and final article from the latest Amundi-Create-Research Survey

-

Features

FeaturesAustralia: Regulator targets greenwashing

Vanguard, one of the world’s largest investment managers, suffered the indignity in December of being the second company in Australia to receive an infringement notice for alleged greenwashing.

-

Features

FeaturesCentral banks and the weaponisation of finance

The US has been a global power since the second world war. But it was during the interval between the collapse of the USSR in 1991 and the rise of China in the 21st century that the US was perhaps the single global hegemon.

-

Opinion Pieces

Opinion PiecesAustralia: Super funds face the future of fossil fuels

After a year when fossil fuel stocks outperformed all other shares, Australian super funds face a conundrum – to buy, hold or sell?

-

News

NewsNorges blacklists Indian, Chinese state firms on Myanmar risks, after holding €32.2m

Chinese state-owned AviChina Industry & Technology and Indian government-owned Bharat Electronics now excluded from Norway’s giant SWF

-

Special Report

Special ReportDC Pensions: Australians exercise pension choice

While the default MySuper dominates the superannuation industry, Australia’s defined contribution system offers a complex and wide range of options for retirement

-

News

Norway’s SWF worried about Japan’s lack of female corporate leaders

NBIM speaks out on gender diversity on Japanese company boards