Asia-Pacific: Pensions and Investment News and Analysis – Page 3

-

News

NBIM bans stocks for links to Myanmar government, journalist surveillance

Norway’s giant SWF blacklists PTT PCL and Cognyte Software on human, individuals’ rights risks, ends observation of Leonardo

-

Special Report

Special ReportProspects 2023: Does zero China make sense?

Many investors are avoiding the People’s Republic, but they would do well to look at the reality

-

Special Report

Special ReportSpecial Report – Prospects 2023

The past year will be remembered as one of the most challenging for institutional investors ever. The outlook for 2023 is brighter, if anything because valuations of major asset classes have come back to historical levels.

-

Opinion Pieces

Opinion PiecesAustralia: Supers face A$500m tax hit

In the lead-up to the first budget by a Labor government in 12 years, speculation was rife about what the new Australian government might have in store for the superannuation sector.

-

Features

FeaturesUS dollar strength and the issues facing institutional investors

Most central banks across the world are raising interest rates – some more aggressively than others – but it is proving hard for any of them to out-hike the US Federal Reserve. The resulting widening interest rate differentials have been an important factor in the appreciation of the US currency.

-

Opinion Pieces

Opinion PiecesAustralia: Super funds shift focus to private credit

An ambition of the architects of Australia’s universal superannuation system, when it was set up in 1992, was to create what would become a fifth pillar of the nation’s banking system.

-

Special Report

Special ReportAsia investment: GIC enhances sustainability focus

A sustainability office now complements a sustainable investment fund that was launched in 2020

-

Special Report

Special ReportAsia investment: Japan’s GPIF assesses new strategy

World’s largest pension fund aims improve its allocation to ESG indices following a positive five-year track record

-

Special Report

Special ReportSpecial Report – Asia investment

Investors steadily withdrew from emerging Asia equity markets this year, taking nearly $30bn out of the markets in the seven months to the end of July, with six consecutive months of outflows. Tech-oriented Taiwan and South Korea were most affected and India was not unscathed.

-

Special Report

Special ReportAsia investment: Focus shift brings turmoil to emerging Asia equities

Enthusiasm about Asian equities has cooled on the back of global recession risk, geopolitics and inflation

-

Special Report

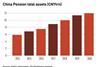

Special ReportAsia investment: China edges closer to a national pension plan

Foreign managers see opportunities in new US 401(k)-style pensions, with vast asset growth potential

-

Opinion Pieces

Opinion PiecesAustralia: Role for superannuation in nation-building

A new Labor government has set the scene for change in Australia’s growing superannuation industry to ensure that some of the country’s A$3.3trn (€2,3trn) savings pool is directed toward social housing and the energy transition.

-

Asset Class Reports

Asset Class ReportsEmerging market debt: China government bonds

The outlook for Chinese government debt is looking less attractive

-

Features

FeaturesCan a sinking market re-emerge?

Travelling around Sri Lanka in mid-July reminded me of Winston Churchill’s saying that “democracy is the worst form of government – except for all the others that have been tried”. Many in Sri Lanka would argue that the post-independence history of the country may have proved him wrong. This year, political upheavals after popular demonstrations caused the administration of President Gotabaya Rajapaksa and his elder brother, Prime Minster Mahinda Rajapaksa, to collapse after the Rajapaksas’ deep corruption and deeper ineptitude over two decades brought economic ruin as the country ran out of foreign exchange to pay for fuel imports.

-

News

NewsNBIM favours Japan human rights corporate code linking to SASB/ISSB reporting

Norwegian SWF manager also stresses need for companies and government to monitor what happens next

-

Opinion Pieces

Opinion PiecesAustralia: Downturn casts a shadow over super anniversary

Australia’s superannuation industry enters its fourth decade under the darkening clouds of a global economic slowdown that is already having a dramatic impact on returns.

-

News

Schroders identifies persistence in private equity returns [updated]

Research by Schroders Capital finds that past performance could be more instructive for some parts of the private equity market than others

-

Opinion Pieces

Opinion PiecesAustralia: Superannuation funds on a consolidation path

Australians are beginning to get used to super funds with names like Australian Retirement Trust, Aware Super and Spirit Super.

-

Features

FeaturesChina calls the tune for emerging markets

If President Xi Jinping mismanages China, the careers of many emerging market asset managers could be over. It would also mean emerging markets as an asset class would become irrelevant, at least according to Xavier Hovasse, head of emerging markets at the French fund management house Carmignac, who has devoted his career to seeking opportunities in emerging markets.

-

Special Report

Special ReportTop 500 Asset Managers 2022

The emergence of persistent higher inflation, China’s zero-COVID policy, stress on global supply chains, and Russia’s Ukraine war all suggest that the asset total of this year’s IPE Top 500 Asset Managers Guide represents a high water mark.