The sustainable bond market has rebounded in 2024 after a period of stagnation.

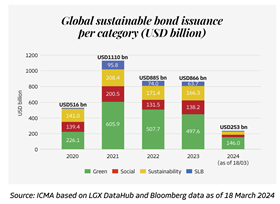

The International Capital Market Association (ICMA) has welcomed “encouraging numbers” for sustainable bond issuance after it fell by 2% last year, compared with 2022.

More than half of sustainable bonds in 2023 were dedicated to green spending, with 17% being focused on areas of social responsibility.

After a boom in recent years, sustainability-linked bonds – those with an interest rate tied to achieving entity-level environmental and social targets – fell from 9% to 7% of sustainable bonds.

In the first three months of 2024, however, sustainable bond issuance grew 12% compared with the same period the previous year, hitting $253bn (€2.6bn).

Wider bond markets also grew, meaning that while 2023’s issuance represented 12% of all bonds issued, this dropped to 11% during the first quarter of 2024, despite the growth in absolute numbers.

Sovereigns, supranationals and agencies have been the biggest issuers, representing 55% of sustainable bonds so far this year, at $138bn – an 18% jump on the same period last year.

Notable deals include Japan, which in February became the first sovereign to tap the ‘transition’ bond market, and the African Development Bank, which was the first supranational to sell a “sustainable hybrid capital transaction” in line with the G20 Capital Adequacy Framework recommendations.

Romania, Iceland and Ivory Coast have all tapped the sustainable or green bond market for the first time in 2024.

On the corporate side there was a 4% rise in deals, including debuts from big names like chemicals giant Dow, carmaker Mazda and tourism firm TUI Group.

ICMA oversees the Green Bond Principles and a number of other global guidelines for issuers and investors wishing to participate in credible sustainable bond markets.

Read the digital edition of IPE’s latest magazine