Green Bonds – Page 6

-

News

Denmark urgently needs an energy independence plan, says pensions lobby

‘Even before the war in Ukraine, we were faced with an urgent task in the green transition,’ says IPD CEO

-

Features

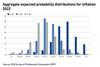

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

News

KLP, Nordic banks, launch transition financing code for shipping

‘Guidelines for Transition-linked Financing’ for the shipping industry aimed at increasing transparency around firms seeking rate discounts on loan/bond financing

-

News

NewsVBL picks Amundi Deutschland for green, social bonds worth over €1bn

The bonds are subject to strict criteria by the International Capital Market Association

-

News

NewsSustainable bond issuance growth to slow on way to $1.35trn total in 2022 – Moody’s

Prediction that sustainability-linked bond issuance to more than double, however

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Is Europe on track to become sovereign?

The Next Generation EU (NGEU) programme is designed to speed up the EU recovery and spur growth over the medium and long term. More importantly, it represents a unique opportunity to lay the foundations of a deep and liquid European safe asset.

-

News

Alecta says $75m blue bond investment meets sustainability, risk/return needs

Bond will enable Belize to refinance existing debt at lower cost, releasing $180m earmarked for marine preservation, says Swedish pension fund

-

News

Master trust launches green impact strategy with Wellington, Lombard Odier

Wellington will manage impact bonds with both a climate and social focus, whilst Lombard Odier will manage bonds focussed on positive climate impact

-

Asset Class Reports

Asset Class ReportsThe green bond imperative

A deepening pool of green bond issuance is allowing investors to direct capital towards objectives like energy transition

-

News

Danish pension funds cheer news of first domestic state green bond

IPD positive on central bank using Germany’s tried-and-tested twin-bond model

-

Country Report

Country ReportFunds collaborate on green credit

Swedish funds team up with fund managers by providing seed money for two new sustainable bond products

-

Special Report

Special ReportNextGenEU: Towards a new euro yield curve?

Bonds designed to support member states hit hardest by the pandemic look set to become a new safe asset

-

Opinion Pieces

Green bonds – a ‘no-brainer’ paragon

Institutional investors are constantly searching for the elusive ‘no-brainer’ investment: the one that offers clear additional benefits without additional risk

-

News

EU green bond attracts interest over €135bn

Yield of 0.4% for a 15-year bond is too low, PMT says

-

News

ATP ditches €800m US HY exposure to buy €1bn green corporate bonds

Danish pensions giant says shift to green bonds within investment portfolio is part of future-proofing efforts

-

Opinion Pieces

Opinion PiecesAn alternative pensions future

It’s no real news that ageing is changing our society in numerous ways – from simple things like product design (making smart phones for older eyes and fingers to use) to more generationally diverse workplaces.

-

Asset Class Reports

Asset Class ReportsEmerging Market Debt: Populism battles ESG in Latin America

Many policies championed by populist leaders in Latin America are in direct conflict with the ESG goals of global investors

-

News

AkademikerPension’s board ramps up climate investment plan

Danish labour-market pension fund nearly doubles 2030 target for ‘climate-friendly’ investments

-

News

UK green Gilt not green enough, says Triodos

Triodos IM will not invest in the first UK green Gilt that will be issued next week

-

Features

FeaturesResearch: Engagement key to navigate the raft of social complications

Simon Klein and Amin Rajan find investors are opting for more social-related investing