Green Bonds – Page 8

-

Features

FeaturesBriefing: Tide turning for ESG fixed-income

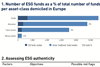

The supply of ESG-aligned bonds is increasingly underpinned by regulatory pressures and client demand for products targeting non-financial objectives. As the investable universe grows, so the number of funds and assets will increasingly find their way towards fixed-income ESG solutions. However, to strike the right balance between financial and non-financial returns investors should look for ESG-authentic leaders with good risk-return capabilities

-

News

NewsMandate roundup: Swiss scheme tenders green bonds

Plus: Scottish Enterprise awards admin, actuary and investment consulting mandates

-

News

NewsESG roundup: NN IP sees €300bn green bond issuance next year

Plus: GPIF allocates to gender-diversity index; Denmark’s Sampension adds 79 stocks to blacklist

-

News

NewsSweden’s Kåpan ups green bond weighting, expands fossils strategy

Swedish government employees’ pension fund says it bolstered sustainability in asset classes as well as overall operations this year

-

News

Commission to use rescue plan to create ‘European yield curve’

‘In addition to issuing bonds with a maturity of up to 30 years, there will also be an emphasis on the short end’

-

Features

FeaturesBriefing: Germany finally issues green bonds

There was little doubt that the German finance ministry would eventually tap the green bond market. Germany is committed to reaching net zero greenhouse emissions by 2050.

-

News

ECB makes ‘exceptional exception’ for sustainability-linked bonds

ECB to accept SLBs as collateral and as eligible for buying under its asset purchase programmes

-

News

NewsAlecta invests SEK4.25bn in Swedish state’s first green bond

Investment expands pension fund’s total green bond portfolio to SEK50bn

-

News

Germany green bond-linked spending spans real, intangible assets

Federal government has unveiled the framework for its upcoming inaugural green bond issuance

-

News

Germany commits to sustainable capital market with green bonds plan

The government will issue ‘twin bonds’, green bonds and conventional bonds, with a 10-year maturity and an identical coupon of 0%

-

Opinion Pieces

Opinion PiecesViewpoint: Returns to ESG investing - looking for the light

A fundamental question for investors is whether ESG investment involves a tradeoff, a combination of environmental philanthropy and reduced financial returns, or whether ESG investment will simply deliver the best returns to investors.

-

News

BTPS keen for big voice in ESG/fixed income debate, says CEO

Credit rating agencies should step up their game on ESG, Nilsson says

-

News

Nordics roundup: ATP, PFA back EIB’s climate bond

Norway’s AFP pension fund taps eVestment; PFA re-hires NNIT as digitisation increases

-

News

Industriens reshapes largest bond mandate into €1.2bn ESG fund

PIMCO tailors portfolio, only using issuers with low environmental impact, high social responsibility, healthy governance culture

-

News

Sampension boosted green bond investments by DKK300m in 2020

Danish occupational pension provider sees pickup in green bond issuance after pandemic-linked dip

-

News

NewsHSBC, IFC raise $320m extra for EM real economy green bond fund

European occupational pension funds and insurance companies commit to ‘impact solution’

-

News

ATP’s green bond allocation hits 3.9% as it buys into new NIB issue

Denmark’s biggest pension fund invests in seven-year environmental bond issue

-

News

Japan’s GPIF partners with Dutch ministry in green bonds move

The fund also formed a partnership with Kommuninvest to develop sustainable capital markets through a focus on green bonds

-

Interviews

InterviewsHow we run our money: AP2

Lars Lindblom (pictured), global fixed-income manager at the second Swedish buffer fund, talks to Carlo Svaluto Moreolo about the fund’s evolving green bond investment strategy

-

Special Report

Special ReportGreen bond issuance: Denmark's split offering

The Danish government is keen to employ tradeable green certificates, which are designed to broaden the appeal of environmental debt, in its initial green bond issuance