Green Bonds – Page 3

-

News

NewsEU urged to make Green Bond Standard mandatory as ESMA consults on reviewer rules

Commission pushes back on claims it has not done enough to promote transition

-

News

NewsFolksam invests €222m in Stockholm climate adaptation bond

Municipal pension fund subsidiary KPA Pension takes up €89m of group’s investment in bond

-

News

NewsPension funds look to sell real estate investments

Investment-grade bonds and private credit are the most popular asset classes, according to a GSAM pension fund survey

-

Features

FeaturesA bumper year for convertible bond issuance

The convertible bond market ended 2023 on a strong note with its main index – the Refinitiv Global Focus – returning 6% in the fourth quarter. The optimism has continued into 2024 on the back of reasonable valuations, historically low equity volatility and better opportunites.

-

Interviews

InterviewsMuzinich’s Tatjana Greil Castro on credit fundamentals

In one of the meeting rooms of the London office of Muzinich & Co are displayed a series of bond certificates from the past.

-

News

NewsEU Green Bond Standard is step in right direction to tackle greenwashing, says IEEFA report

However, IEEFA calls for follow-up measures, such as revisions of relevant EU sustainable finance regime and launch of a comparable impact reporting framework

-

Features

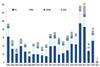

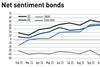

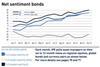

FeaturesIPE Quest Expectations Indicator - February 2024

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

News

NewsSweden’s Folksam, KPA invest €35m in Skåne green bond

Most of investment taken up by municipal pension fund subsidiary KPA, which lauds hospital financing

-

Features

FeaturesIPE Quest Expectations Indicator - January 2024

It is safe to predict that 2024 will be a year of desperate campaigning. Political surprises in the US and UK are possible and, this time, they do make a difference to markets

-

Features

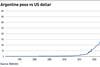

FeaturesWill delayed economic bad news hit the market this year?

Global economic growth was below potential in 2023, but still markedly stronger than the forecasts had been indicating at the start of the year, with the US leading the way and even the likes of Europe and the UK, though hardly stellar performers, posting better than expected economic activity.

-

Interviews

InterviewsBarings: A bond investor for changing times

Martin Horne is the new global head of public assets at Barings bond investor, but he is a bond guy through and through.

-

Asset Class Reports

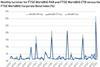

Asset Class ReportsFixed income: Investors put weight behind bond markets

Exposure to bonds is rising at the fastest rate since the financial crisis, as investors focus on high-quality paper and the shorter end of the yield curve

-

Features

FeaturesNet zero’s bond index problem

The fixed-income space has not been short of sustainability innovations over the years.

-

News

NewsGerman regulator to check European green bonds issuers obligations

Green bond issuers must publish an information sheet before issuing the bonds, which includes essential information on planned taxonomy-compliant use of proceeds

-

News

NewsEBRD starts process to rebuild Ukraine calling on investors

Key priorities for the war-torn country are keeping up economic growth and establishing a defense industry

-

Features

FeaturesIPE Quest Expectations Indicator - December 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

FeaturesIPE Quest Expectations Indicator - November 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

News

NewsSwiss pension funds clean up investment portfolios

Climate Alliance has seen in the past year an increase in pension funds’ impact investments, ranging from 1% up to more than 10% of schemes’ AUM

-

News

NewsESMA study fails to find a systematic greenium for sustainable bonds

EU supervisory body researchers say willingness to accept lower returns for ESG is limited

-

News

NewsKPN pension fund to invest up to €700m in private debt

The €10bn pension fund considers the asset class a vehicle for impact investing