Green Bonds – Page 2

-

News

NewsVelliv says impact product revamp ‘in theory makes for better returns’

Danish mutual pension provider redesigns ideas behind VækstPension Aftryk, defines four categories of sustainable investment targets, adds asset classes

-

Features

FeaturesIPE Quest Expectations Indicator - October 2024

In generic US polls, Democrats beat Republicans, with a small but increasing margin, signalling an opportunity for reforms if Kamala Harris wins and a continuation of a divided and blocked Congress if Donald Trump wins.

-

Features

FeaturesFixed income, rates, currencies: All eyes are on US elections

With so many important elections taking place this year, politics were likely to have an outsized influence on financial markets.

-

News

NewsSweden’s AP7, AP2, AP3 back World Bank’s SEK2.6bn EM blue bond

Bond issue designed to promote ocean-friendly projects and improve access to clean water and sanitation in emerging markets

-

Special Report

Special ReportTop 10 European pension funds raise equity and bond exposure

Pension funds in most European countries recorded strong returns of between 6% and 9%, according to preliminary figures published this summer by the OECD.

-

Features

FeaturesIPE Quest Expectations Indicator - September 2024

Kamala Harris’ candidacy has turned the political mood in the US. The two candidates are very close together in the polls but while Trump’s score is stable – except for a worsening favourability – Harris’ statistics all show a positive trend.

-

Features

FeaturesFears grow of US slowdown

US president Joe Biden’s decision to step aside was much murmured about following his disastrous performance in a debate with Donald Trump, but it was still a surprise when he announced his decision. However, market reactions were relatively muted, despite shaking pollsters’ predictions on who might now win the election.

-

News

NewsNew guidelines seek to define sustainability-linked loan bond instrument

ICMA body also released guidance for ‘green enabling projects’

-

Features

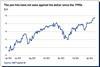

FeaturesMarket predicts US soft landing - June 2024

A combination of Federal Reserve chair Jerome Powell’s press conference and a slightly weaker-than-expected US April non-farm payrolls outcome succeeded in flipping the market back to a soft-landing narrative for the US economy. US Treasury bonds rallied sharply, taking other markets with them, while the yen weakened significantly against the dollar before recovering.

-

Features

FeaturesIPE Quest Expectations Indicator - June 2024

Trump and Biden are both losing to undecided voters, a group that is now unusually large and may be sensitive to Trump’s legal troubles. Biden’s approval rate is below his score in presidential polls, while Trump’s score is the same in presidential polls and those measuring voters’ opinion of him. In the UK, the Conservatives took another drubbing in the local elections.

-

Opinion Pieces

Opinion PiecesWhat happens if we burn all the carbon?

As someone who started his career working for Shell International (albeit four decades ago when fossil-fuel-induced global warming was not an issue that we were aware of), I do not believe that oil companies are inherently evil.

-

Features

FeaturesIPE Quest Expectations Indicator - May 2024

EU parliamentary elections are approaching fast. Current polls predict a shift to the right, with the current centrist parties remaining dominant and the extremist right overtaking the Eurosceptics. US President Donald Trump is still liable to be convicted in a criminal case, but his poll figures are rising.

-

Opinion Pieces

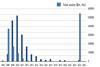

Opinion PiecesBond markets look set to become the new stewardship powerbroking arena

Investors in bond markets are starting to assume a more powerful position than equity investors to influence companies and countries. Innovation is sweeping through bond markets with the introduction of specific ‘use of proceeds’ bonds and sustainability-linked bonds.

-

Asset Class Reports

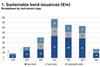

Asset Class ReportsClosing the data gap in green, social and sustainability-linked bonds

Luxembourg’s bourse has capitalised on its experience as a green bond hub

-

Asset Class Reports

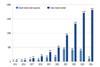

Asset Class ReportsGreen bonds reach escape velocity

The green bond market looks set to grow further, despite pressure from many sides and key questions over their function

-

Features

FeaturesUS economy continues to surprise

The resilience of the US economy continues to confound observers. The Federal Reserve’s 11 hikes in interest rates over the course of 2022 and 2023 were implemented to rein in economic strength and to stifle inflation. Scroll forward to the second quarter of 2024 and both inflation and economic activity are still higher than expected.

-

Asset Class Reports

Asset Class ReportsThe quest for innovation in sustainable fixed income

Japan’s climate transition bond is the latest in a string of innovative developments in sustainable fixed income

-

News

NewsFirst quarter sees uptick in sustainability bonds

Market represents a lower proportion of wider bond markets, despite recent growth in issuance

-

Opinion Pieces

Opinion PiecesATP at 60: no plans to retire the guaranteed pensions model

Now approaching retirement age itself, Danish statutory pension fund ATP is using its 60th birthday as an opportunity to reinforce the validity of its guarantee-based investment model.

-

Features

FeaturesReluctance to drop interest rates disappoints the markets

US rates markets entered the year enthusiastically pricing in over 160 basis points of cuts through 2024, and have since had to push back hard on both the timing and magnitude of interest rate cuts now expected by year-end.