Green Bonds – Page 9

-

Special Report

Special ReportTransition bonds: Questions of transition

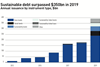

The market for sustainable investments is growing exponentially

-

Interviews

InterviewsOn the record: Green bonds

IPE asked two Nordic pension funds how they invest in green bonds and to what extent sustainability is considered part of their fixed-income strategies

-

Special Report

Special ReportPrivate and green: Non-listed sustainable debt

The market for non-listed debt with green or sustainability features is growing fast

-

News

NewsSwedish trio stows €271m into social bonds to support Corona-hit firms [Updated]

Swedish pensions and insurance groups buy debt issued by the International Finance Corporation

-

News

NewsLargest Dutch schemes positive on SDG bond

Enel commits to paying additional 25bps if it fails to meet its target

-

News

NewsNN IP: Green bonds an ‘economic alternative’ to traditional bonds

As interest rates dropped further in 2019, the green bond index performed better than the aggregate index

-

News

NewsPKA takes fifth of latest Dutch green bond issuance

Dutch State Treasury Agency taps markets for a further €1.19bn

-

Features

FeaturesFixed income, rates, currencies: Better than expected

Although packed with geopolitical surprises 2019 turned out to be better than expected for financial assets. Equities and bonds rallied together reversing last year’s ‘unusual occurrence’ of both performing badly.

-

News

Danish schemes open to central bank’s ‘separable’ green bonds plan

ATP, Sampension, Danica and PFA Pension await final details and pricing

-

News

NewsESG roundup: EU benchmarks, disclosure regs get final rubber stamp

Plus: GPIF forges ahead with additional green bond partnership

-

Special Report

Focus on Fixed Income: Actively managing today’s green bond opportunities

In this article we examine the process for green bond labelling and certification and its implication for index investors. Passive (index-tracking) green bond funds are bound by eligibility rules and each index has its own labelling requirements.

-

News

NewsUN Climate Summit: Danish pensions to lead green transition with €47bn pledge

PensionDenmark, PKA, PFA and PenSam all represented Denmark’s pension industry at the UN Climate Action Summit in New York

-

News

Netherlands roundup: BpfBouw appoints fiduciary for property investments

Also: €8.6bn postal scheme PostNL allocates 2% to green bonds via NN Investment Partners mandate

-

News

Amundi teams up with Asian infrastructure bank for $1bn climate bond fund

Also: AXA IM launches impact fund focused on Asia, Africa and Latin America; NN IP green bond fund reaches €1bn

-

Special Report

A green game changer

New EU green finance requirements will increase demand for better and more comparable ESG data

-

Special Report

EU Sustainable Finance: The greening of Europe

The EU wants to encourage environmentally friendly investment practices. Will its taxonomy stimulate the green bond market?

-

Special Report

Viewpoints: The industry reacts

Will the EU Sustainable Finance Technical Expert Group’s June 2019 reports on the green taxonomy, green bond standards and climate benchmarks succeed in mobilising investors and capital in support of sustainability objectives?

-

Special Report

Viewpoints: Investment as the saviour

How taxonomy, trajectory and Ecolabel could save our children

-

News

AP3 sets sustainability goals, seeks to double green investments [updated]

Sweden’s third AP fund pledges to halve its carbon footprint by 2025 and invest €2.8bn in green bonds

-

News

NewsESMA advises against explicit ESG analysis mandate for credit rating agencies

Watchdog says credit rating agencies should stay focused on creditworthiness, but transparency of how they consider ESG factors could be improved to help investors